In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

Recently the Secure Act, officially known as the Setting Every Community Up for Retirement Enhancement Act (who comes up with these names?), was passed with little attention received except one change which impacts retirees close to their Required Minimum Distribution (RMD) Date. The Secure Act however is much more important than just that one part and will have significant impact on legacies going forward.

Before we get into why this is so important for all age groups, let’s first review the major changes in the act. There are 10 major parts to the act but I am just going to focus on the major changes that will have the most impact (saved the most important for last).

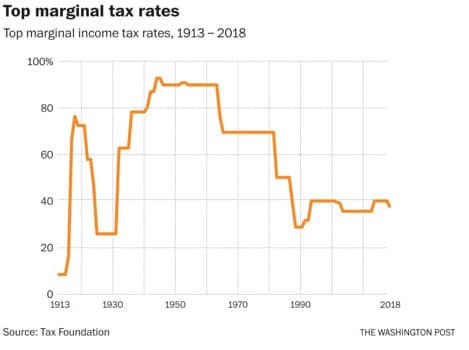

The rules have now changed significantly. Stretch IRAs are now limited to a 10-year max. Instead of deferring taxes over multiple decades, the IRA must be spent down in 10 years. Why is this important? Two reasons. First, on a smaller scale, it could have a significant impact on trusts that have a pass thru feature for IRAs. Please see your estate planner if this could possibly impact you. Two, from a perspective that may impact many more people, take a look at the following chart:

As you can see, top marginal tax rates are close to historical lows. With our national debt issues, is it realistic to expect these to stay low? Do you think they are likely to go lower? I don’t. It is important to note, this is important regardless if you are talking about distributions during your life or your beneficiary. You could possibly be deferring taxes into a much higher tax rate environment OR burdening your children with high tax liabilities.

When you are young, it is pounded into your head by the media and advisors who don’t think it through to “max out your 401ks.” Should you? If you don’t want to run the numbers, let us so you can see what happens if the tax rate tops out at 80% again and you deferred income. I believe most would agree that you should take advantage of the company match. What about after that? There might be better avenues, like:

It is important to know your risk. It is also important to plan for the future when it comes to wealth. That is if you care to maximize your wealth.

If you would like more information on the three potential avenues listed above, please feel free to give us a call.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. The term “Stretch IRA” was a marketing term used to describe an IRA that was set up to extend the period of tax deferred earnings beyond the lifetime of the individual who created the account. The accounts were typically designed to last over multiple generations. The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change. Traditional IRA account owners should consider the tax ramifications, age and income restrictions in regards to executing a conversion from a Traditional IRA to a Roth IRA. The converted amount is generally subject to income taxation. The economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.