It’s hard to believe that tax season is here already. In an effort to help our clients be...

“If there is unemployment in America, it is because the unemployed do not want to work.” Henry Ford

A quote never truer than today, or is it?

One of the more surprising issues to come out of the Covid 19 recession and remarkable rebound is the unemployment rate, or more specifically, the number of unfilled jobs even though the unemployment rate it still too high. There are jobs but the unemployed are not interested in filling them.

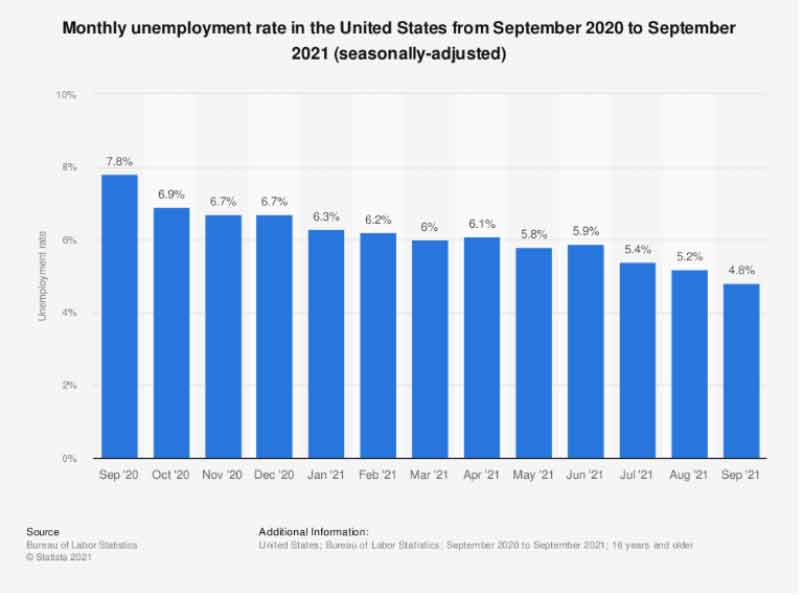

This has stumped economist across the nation. There are many speculations but few facts on why unemployment stays high even though we see so many unfilled job openings. Many, including myself, thought we would see a much bigger drop in the unemployment rate when the extra unemployment benefits expired in September. However, as you can see from the below chart, we didn’t.

To look at it a different way, nonfarm employment is still 5 million below the pre-pandemic numbers.

Here are some of the reasons speculated for this dichotomy and the reason this can’t be the entire story:

There is a huge issue with those reason though. If you break down the unemployment by demographics, you will see those reasons are not sufficient to explain the entire issue. They most definitely contribute to the problem. For example, we witnessed a spike in the number of Americans retiring since Covid. The Federal Reserve Bank of Kansas City reported an increase of approximately 1% in people retiring from February 2020 to June 2021. Also, participation rates among women have actually dropped. Per The U.S. Bureau of Labor Statistics, labor participation rates among women were approximately 57-58% pre pandemic but sit at 55.9% in September of 2021.

However, there is one area not receiving enough attention regarding the employment puzzle we see today. This is the significant increase we have seen in the savings rates in the country since the pandemic. Again, per the U.S. Bureau of Labor Statistics, the savings rate ranged from approximately 5% to 10% from 1990 to 2020. Then the pandemic hit. Due to the stimulus package and an unprecedent economic recovery (including stock market rally), the savings rate actually hit a high of 33.8% in April of 2020. The previous recorded high was 17.3% in 1975. Keep in mind the previous high was in May of 1975 when it hit that 17% number. It quickly fell back under 15% the next month, never topping 15% again until the pandemic. Here are the monthly savings rate post the pandemic:

In August of 2020, it dipped below 15% again. We then saw two more spikes in 2021 that reached 20% (January) and then 26.6% (March).

The latest reading shows an interesting 7.5% in September of 2021. When the money runs out, people will have to work. This is supported by a recent survey performed by the internet staffing firm Indeed. They found that 28% of those polled stated a larger financial cushion is the reason for their lack of urgency.

In summary, Covid has rocked our world on many fronts. Many of the expectations pre-covid no longer apply in today’s world. People retiring earlier, woman staying home more either due to the their choice or due to a lack of daycare workers, the significantly smaller number of legal immigrants have all led to the situation we face today. Baby boomers shouldn’t point to the millennial’s work ethic, this is much bigger than that.

This is very important though because wage inflation leads to more inflation pressures. My next article will be a follow up to my inflation article and video from the summer. You can read both of those articles by clicking the links. I would love to discuss this further with you if you have any questions feel free to call me at 817-717-3812.