In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

“Discipline is the bridge between goals and accomplishments” as quoted by Jim Rohn.

Truer words have never been spoken in regards to investing. It is crazy out there. A couple weeks ago I wrote an article titled “Wear Sunscreen.” I mentioned that many market corrections are brought about by the unexpected, not expected risks. Impeachment trials, trade war, nor inflation rates created this mess. An unexpected “black swan” event did. You can’t predict them.

The question becomes will an investor be disciplined or reactive? Will an investor use their critical thinking skills or emotions? I have written several times in the recent past about my concern regarding the amount of risk the average person over 50 was taking in their portfolios. In one of the greatest bull markets in our history, at least in length, it is easy to do. How many of us have joked that the market was never going to go down? But the market does go down. And it can go down in an ugly fashion.

Greed is a powerful emotion. So is fear. Both of them create a very bad combination. Quick, name the greatest investors of all time, excluding me of course. How many of you thought of Warren Buffett, Peter Lynch, Benjamin Graham, George Soros? How many are traders versus investors with a long-term outlook? Sorors is the closest to a trader but even he stated “The idea you can predict what is going to happen contradicts my way of looking at the market.” How can you time the market if you can’t predict the market? Think about that.

How many of us know people who got out of the market in 2008 only to miss a huge bull rally. The problem when selling when scared is typically you don’t want to get back in until all fear is subsided. It is too late then. The market rebounds before the economy gets better.

I recommend thinking more in terms of on-risk vs off-risk. There is nothing wrong with taking some risk off the table. Just don’t put yourself in a position to miss all of the rally when it happens. Also, if you go to cash, how much money are you currently making? If you hold on to a good dividend paying stock or fund, one that you are comfortable will be around long-term, will you not earn a better dividend than cash?

Patience and discipline are needed here. That means don’t chase the short-term rallies and don’t sell into the fear-based drops. When corrections occur, you either have a L, W, V, or U-shaped recovery. For the sake of being as succinct as possible, I am going to skip the L and W-Shaped recovery because I think they are not only the least likely but also the message can be communicated just using the V and U.

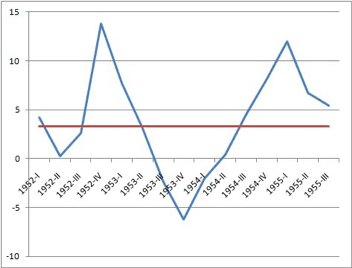

In the 1953 recession, we saw a dramatic V shape recovery: As you can see, we had a steep drop and recovery in 2 years.

I believe, and not one of the experts I follow has opinioned otherwise, that the chance of a V shape recovery is remote. It should not be expected.

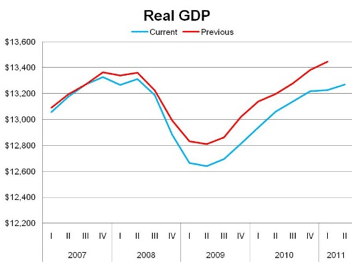

Compare that to the 2008 Great Recession:

As the chart shows, it took three years to go from peak to valley and return to peak. This is what I expect going forward.

I point this out because it supports the message of patience and discipline. In a U-shaped recovery you typically see a “base period” or bottom. I highly doubt the market just moves up from here. We can be patient and rebalance the portfolio. Don’t get caught up in worrying about index performance. The opportunity of being patient is much greater. Our strategy is to move out of stocks or sectors that are expected to be hit the hardest and move into those that we expect to outperform.

But try your hardest not to move to 100% cash. By the time you feel good about getting back into the market, you will have missed the rebound. Just de-risk if you need. Instead of 65% stocks, maybe think 50%. That is our strategy: discipline, patience and de-risking until we see some kind of bottom. We will not chase. When the recovery happens, and I am 100% confident it will, you might miss some return but at least you will make a return. That is better than cash longer-term.

If you have any questions about your portfolio feel free to call and we can discuss, we are here to help you!

The information provided here is for general information only and should not be considered an individualized recommendation or personalized investment advice. All investing involves risk including loss of principal. No strategy assures success or protects against loss. Past performance is no guarantee of future results.