The question of Medicare sustainability is in tandem with Social Security sustainability. Both...

“I found that if you have a goal, you might not reach it. But if you don’t have one, then you are never disappointed. And I’ve gotta tell you, it feels phenomenal.” Peter Le Fleur from Dodgeball

The above is a funny quote from one of my favorite comedies but it is not a great plan when talking money. Without a goal, we move aimlessly, which as Pepper Brooks pointed out, “it’s a bold strategy, Cotton. Let’s see how it works out for them.” Okay, no more Dodgeball quotes from me, at least in this article.So what is your goal when investing your money?

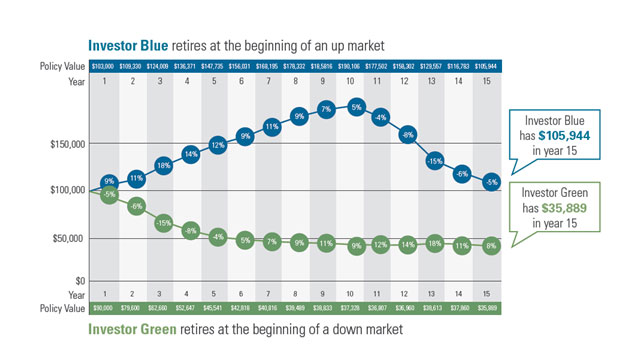

I believe benchmarks, like the S&P 500 index, can be very dangerous when investing because they can distract you from your goals. First, let’s discuss what is referred to as the Red Zone in retirement planning. This is the three years prior to and following a person’s retirement. Sequence of returns is very important in investing. We have written about this before, you can read the article here. Bottom line, if you are taking withdrawals, taking a huge loss in your portfolio earlier in your retirement will have a significantly larger impact on your legacy versus taking the same loss later in retirement.The following chart† shows the difference between a person who begins retirement in a up market versus one who begins in a down market. Keep in mind, the returns per year are the same, just switched from beginning to end. Also, in both cases, $5,000 per year is taken as a withdrawal rate.

As you can see, there is a big difference between the two ending values.

I didn’t really want to discuss the red zone or sequence of returns today but it is important to understand why risk matters so much for your financial goals. It isn’t just retirement planning goals, this applies to college planning for kids, buying second homes, or whatever goal you have that has a start and end date.

I believe investing is about trying to achieve a goal return versus chasing a specific benchmark. Many of you have heard me ask this question before: if you only need, hypothetically, a 6% return to meet your goals, why shoot for 8%? That greed can result in you taking more risk than you need, which might lead to losses that prevent you from meeting your goals. Likewise, if you need 8% but due to your risk tolerance you are only set up to achieve 6% annually, your goals are not achievable without changing your timing of the goal or your savings.

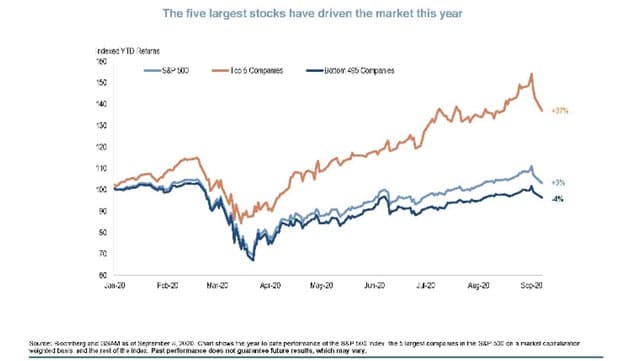

Successful financial planning is about setting goals, tracking to your goals, and being disciplined.Then why do we (including investors, the media, and clients) focus on the S&P 500 so much? Good question, if I say so myself. It is good to have a general feeling for where the market is going. However, the devil is in the details.

Let’s break down the S&P 500 index. How about a “Did You Know” segment?

Did You Know:

The S&P 500 index is a good indicator of the market’s sentiment when looking at movements and trends. It is not a reflection of the typical portfolio of an investor who seeks diversification to manage risk.

Thus, use the S&P 500 for what it is intended: a high-level measure of how the market is performing. The S&P 500 though is not proper diversification, which should include large, mid, and small cap stocks as well as international. More importantly, you should not allow it to take your eyes off your goals. Don’t forget the old wall street adage, “bulls make money, bears make money, but pigs get slaughtered.” Greed is an emotion. Emotions are detrimental to disciplined investing.

One of my favorite quotes in investing, although it fits in many areas of our lives, is Jim Rohn’s “Discipline is the bridge between goals and accomplishments.”

If you are not confident in your goals, your risk, or your timeline, give our office a call so we can schedule a time to discuss your situation in more detail. Regularly scheduled review meetings with your financial advisor help us stay on track and connected with you as your life and assets change. Complimentary consultations are offered if you are not currently working with one of our advisors. We are currently offering phone, Zoom, or in-person meetings (masks required in accordance with Gov. Abbott’s orders). Call us today at (817) 717-3812.

†What is Sequence of Returns, Aria Retirement Solutions.

The information provided here is for general information only and should not be considered an individualized recommendation or personalized investment advice.

All investing involves risk including loss of principal.

No strategy assures success or protects against loss.

Past performance is no guarantee of future results.

The illustrative example provided is not representative of any specific situation.

Your results will vary.

The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.