In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

“The stock market is the story of cycles and of the human behavior that is responsible for over-reactions in both directions.” Seth Klarman

In investing, emotions are the downfall of smart investing and making money. Those emotions go both ways. We see fear stop people from making money in the market all the time. Likewise, letting our ego make us think we have figured out the market or that it is easy can be a very costly lesson.

I am starting to see the emotion of complacency today. We stress test our own portfolios at least twice a year. We use several outside services to help us with this process. This process includes testing to see what should be the expected rise or fall of a portfolio if certain scenarios were to play out going forward. These may include higher interest rates or inflation, a specific drop in the market, or one of many other different scenarios. For example, we run a scenario to see the impact on the portfolio if inflation rises 2% over the next year. We also offer to stress test prospective clients’ portfolios to help them understand some of the risks in their portfolios they might not see.

It is important to note that these tests are not trying to predict the future as much as using history as a guide to calculate how certain investments react to different scenarios.

What we are finding is many people have a significant over-weight to growth stocks, not necessarily on purpose but due to the impressive growth we have seen in tech stocks over the last several years. I am a firm believer that over time, valuations matter. They don’t necessarily matter in the short-term, but they do matter longer-term. I also believe the market typically reverts back to their long-term trend. The market is many mini cycles in one long major cycle. Growth versus value performance is one of the mini cycles. It is unfathomable to me that growth will outperform value stocks for the remainder of the stock market.

I understand that many believe the future is technology and that is where the growth will be. I also understand that regardless of the growth rate of a company’s revenues or earning, there is still a fair price for the company and a stock can still be under or overvalued. I believe at some point, investors may determine that growth stocks are over-valued and value stocks have better opportunities.

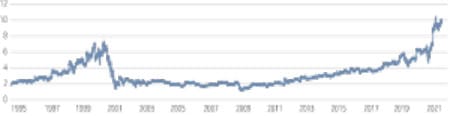

Let’s take a look at the Growth versus Value position we see ourselves in today. The following chart shows the gap between growth and value valuations, in terms of price-to-book going back to 1951.

Source: Bloomberg. Data as of January 12, 2021. For illustrative purposes only.

The chart shows that right now, tech stocks are even more expensive than prior to the dot-com era. There are some caveats here. Valuations cannot be calculated using just one metric. Also, there are other variables that might make an investor pay more for a stock, e.g. low interest.

No matter how you cut it though, growth stocks are expensive. Maybe they keep running or maybe we revert back to the long-term trend line over the next 12 months. No one knows. That is why rebalancing should be a consideration.

Rebalancing is the process of buying and selling parts of a portfolio to ensure you keep the integrity of your asset allocation strategy. For example, hypothetically, Stock Portfolio A, is 40% domestic growth stocks, 40% domestic value stocks and 20% international. Rebalancing is the process of buying or selling different types of those investments, typically once or twice a year, to ensure you keep your same weights.

If you think about it, rebalancing is just a disciplined process of making you buy low and sell high. In the hypothetical above, if growth stocks become 50% of your portfolio, assuming no other changes, that means they have outperformed the other groups. In the process of selling the growth group and bring it down to 35%, you are selling higher and at the same time you are buying a different group that is down, hypothetically let’s say value stocks.

I have been told that rebalancing doesn’t work because one wouldn’t have made as much money over the past several years if they did so. True, but from my perspective, that is a very short time frame. The same thing could be said in 1999 before the dot-com crash. I bet many of those who didn’t rebalance sure wish they would have in early 2000. All it takes is one major correction and then it does make sense. Which leads to some myths and misconceptions regarding rebalancing.

The number one misconception is the impact rebalancing has on returns. This really depends on if you are talking about rebalancing just a stock portfolio or a total portfolio (a portfolio including bonds). Longer-term, it does not increase returns in a total portfolio because you are selling stocks to buy bonds and since stocks typically outperform bonds, you are replacing a higher expected return with one that is expected to earn less. However, it has the potential to reduce volatility for the very reason it doesn’t increase returns.

However, if you are talking about just rebalancing a stock portfolio, meaning just moving between growth and value stocks, it is just the opposite, albeit very minimal.

Rebalancing can be a very solid, disciplined, and simple process for those that are risk conscious. Typically, I don’t know if it matters much if we are just talking about a stock portfolio (no bonds). However, I do think there might be a case for it today. My main takeaway I want you to get from this article is not necessarily that you must rebalance annually going forward. Rather to understand the risk you are taking if things go bad and you don’t rebalance right now. Many of the portfolios we are asked to stress test this year have over 50% of their stock portfolio in growth stocks. Most don’t even know it is that much. If you are one of those, please do me a favor, ask yourself if you are good with taking the risk with the understanding it is possible another dot-com correction hits tech stocks? Please don’t say it can’t happen. As a reminder, please refer to the chart above.

If you aren’t a client but you would like know the level of risk you are taking in your portfolio, let us stress test it for you. I am confident you will find value in this as well as discover some ideas that will help you better meet your goals.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes.

All investing involves risks including possible loss of principal.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All examples listed are hypothetical and not representative of any specific investment.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.