The question of Medicare sustainability is in tandem with Social Security sustainability. Both...

I wrote a recent article proclaiming my love for Warren Buffet and his practical retirement advice, and in that article, one of Buffet’s retirement tips was “Watch Out for Bonds”. This article is meant to supplement, help reiterate, and visualize that point with charts. Who doesn’t love charts!?!?

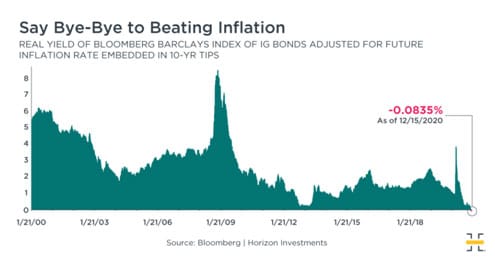

Buffet warns long-term investors about bonds because, even though they seem like safe, cash based investments, they are anything but safe because the value of the dollar falls over time. Think inflation!!! If bonds can’t keep up with inflation, then you are actually losing money and purchasing power, and in our current environment, the Federal Reserve’s forecast for low interest rates is pulling everything else down, so much so that inflation-beating returns are getting harder to find in fixed-income.

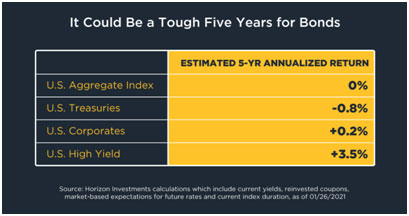

This chart summarizes the estimated 5-YR annualized returns across bond categories.

This chart shows the investment grade corporate bond yield, adjusted for inflation, is now negative.

So, what do we do? How do we protect our portfolios and keep up with inflation? This is where Virtus Wealth Management comes in to partner with our clients to pursue their goals. Our active management approach embraces a diversified set of both traditional and alternative fixed-income instruments designed to keep up with inflation and reduce the potential downside of owning any individual fixed-income segment. Contact us if you would like more information on mitigating inflation risk.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.