In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

We often receive calls during times like early February 2018 when the market drops significantly. In many cases, it is due to worries about how much money one might be losing in the market. We consider this to be a glass half empty view of volatility.

First, volatility is a misunderstood word in investing as it usually only comes up in down markets. However, large moves up in short periods is volatility also. It just happens to be good volatility. We have been spoiled by the current bull market. For the first time in the history of the U.S. stock market, every month in 2017 was a positive month. That sounds great and if we could count on that almost every year, investing would be easy. However, recall that was the first time this has happened since the U.S. stock market opened in 1792. Thus, we should expect the opposite to happen: negative months.

The reason these negative months are your friend is due to the old adage “buy low and sell high.” I believe in fundamental investing first, which is projecting a stock’s future earnings to find companies that have stock prices undervalued. That doesn’t mean that we can’t use technical analysis as well. In fact, I typically use five or more chart indexes when analyzing the ups and downs of the market. Now to be clear, I am not advocating anyone out there become a chartist. This is not meant to be a technical analysis 101 article. The reason I am using this chart here is to better illustrate the ups and downs in the market and how they affect you as an investor.

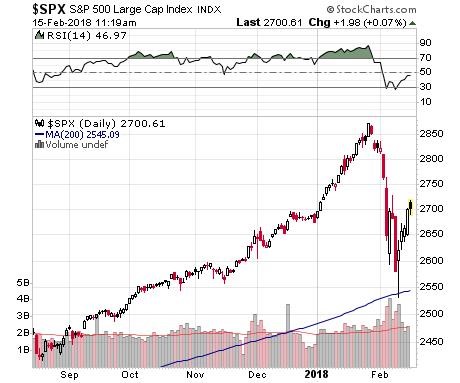

Following is the S&P 500 SPX chart for the last six months, as of February 15, 2018:

There are two sections to this chart. The first section is the top part Relative Strength Indicator (RSI) which has a range from 10-90. If that line gets above 70 it indicates the markets are overbought and a correction is due. If it is below 30, it means the stock market is oversold and a rally is due. The second part of the chart is the actual stock price of the SPX for each day in that period. Black are up days while red are down days.

You can see the SPX has been overbought for the good part of October through January. The dark green area from the end of December through January indicates a very overbought market. Interestingly, we haven’t reached the oversold indicator as of February 12th. This means more downside could be possible.

Patience is a virtue? I think so. When people come into cash and want to invest or someone wants to get more aggressive, being patient may pay off. I am not sure who first uttered the words “buy low, sell high” but I doubt he was talking about charts when he/she said it. Although, I think the charts help us better understand highs and lows.

Bottom line, downside volatility can offer the chance to buy quality stocks that are deemed undervalued. If done right, it could mean more profit, not less. A caveat to consider here is if you are taking distributions from your portfolio for living expenses. If you are taking distributions for living expenses, you should ensure that they are not so high that you end up in a de-accumulation of asset situation. In that case, volatility may be problematic in you hitting your retirement goals. I want you to truly understand when volatility can be your friend and when it can be your enemy so that you can feel confident in not worrying during times like last month when the market was down. If you have any questions about this article or your portfolio give me a call at (817) 717-3812.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Stock investing includes risks, including fluctuating prices and loss of principal. There is no guarantee that security values will return to prior levels.

No strategy assures success or protects against loss.