The Social Security Fairness Act was signed into law in January 2025. This Act repeals two...

Ever try a hot pepper and think, “that wasn’t so bad,” only then after a brief delay to have the burn start building up? You then find yourself running to find anything to drink to put out the fire in your mouth? Sometimes, it takes a while for something to hit you. As Steve McQueen told the tale in the Magnificent Seven of the man who fell off a 10-story building, screaming as he passed each floor, “so far so good.”

We might be currently witnessing this in a different way in the markets. To set the table, we just finished a period of historic rate hikes in an attempt to stop inflation. The stock markets typically do not perform well when the Federal Reserve is raising rates to fight inflation and that proved out to be the case last year as well. For many reasons, higher interest rates slow the economy. The Fed tries to facilitate a “soft landing” by raising rates just enough to slow inflation but not cause a recession. This is complicated due to the fact it takes time for movements in interest rates to work through the economy, good or bad.

During my daily research, I came across some interesting information regarding how the stock market has reacted during interest rate hikes that goes past the initial reaction. This research shows a trend that is very logical if we keep the hot chili pepper in mind.

What the data posted below shows is that once the Fed stops raising rates or the expectations become that the hikes will soon stop, there can be a rally in the markets due to the expectations that all is fine or the worst is behind us. This really comes from an unrealistic viewpoint. Like eating the hot chili pepper, sometimes upon first thought, it really isn’t so spicy. Investors can think the Fed is no longer going to raise rates and since the economy isn’t so bad, jump to the conclusion that all is fine. At that moment, the economy isn’t that bad. Unfortunately, it takes time for the rate hikes to work through the economy. A rate hike today isn’t all absorbed by the economy in one day or even month. By the time the full effect of the rate hikes make their way through the economy, the damage often is worse than the expectation.

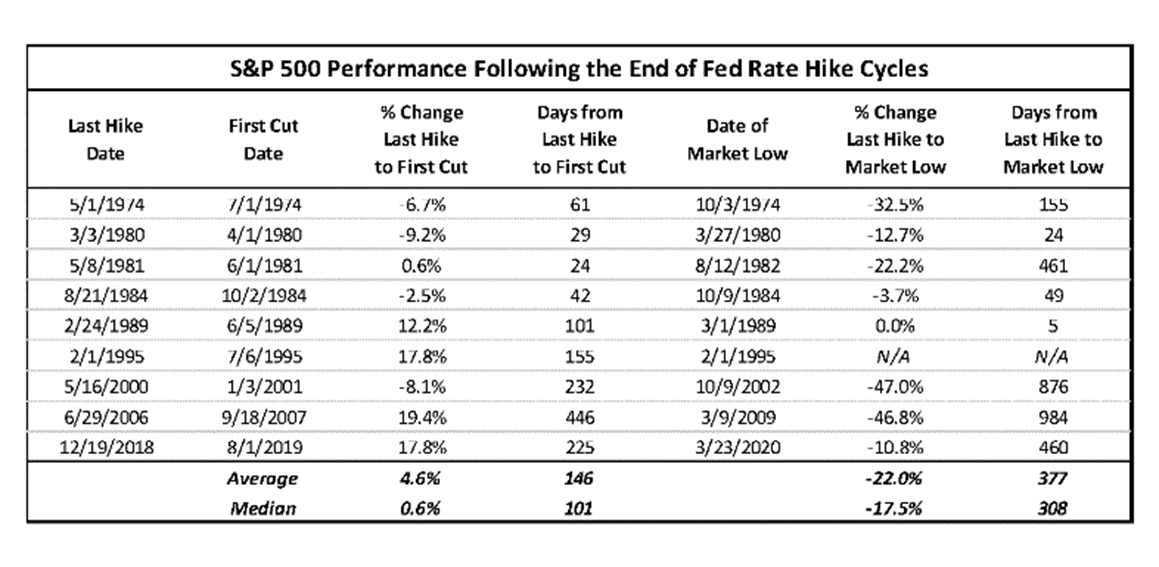

The following chart by Manning and Napier shows that the last nine times in which the Fed has gone through a cycle of rate hikes, there is typically a rally after the last cut. This rally can sometimes be significant but the average rally is approximately 5%. This is that “hey this spice isn’t so hot” rally. Unfortunately, only twice in the last 9 cycles has the market continued to rally after the last cut and avoided a negative correction. In the other seven rate hike cycles, the markets were not able to avoid the negative correction.

We must be careful with jumping to a conclusion here because there are other circumstances that impacted those cycles. For example, in 2001, there was 911. The 2006 cycle was followed by the meltdown of the banking system. Being cautious when investing is prudent, staying in cash worrying about black swan events, like another 911, may be problematic long-term.

Bottom line even excluding 2001 and 2007 due to the other circumstances that impacted the decline, after the last hike, the average decline was over 13%, with the best being basically flat and the worst being down 33%.

Let’s not forget the yield curve is still inverted which can be a sign that a recession is in the near future.

Trying to time the market by going all cash has proven to be a failed strategy over time. We can become more cautious with the goal to protect the downside but still make some return if the economy or markets prove to be more resilient. This is the strategy we believe is most prudent today.

If you have any questions regarding your situation, please feel free to call us at 817-717-3812.