In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

Five tips to help you rework your plans in a post-COVID world.

Here we are in the post-COVID world. Well, at least, I hope we are!?!? The COVID-19 pandemic had a major impact on all of us, including our retirement plans.

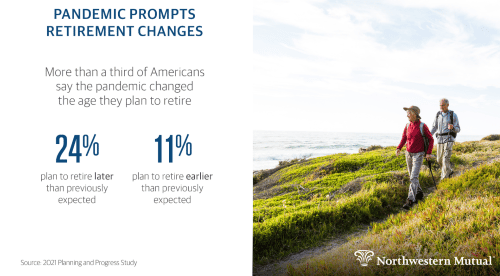

According to a Northwestern Mutual 2021 Planning and Progress Study, more than one-third (35%) of Americans say they have changed the age when they plan to retire due to the pandemic. Some people are adjusting their plans to retire earlier, while others are delaying retirement and working longer.

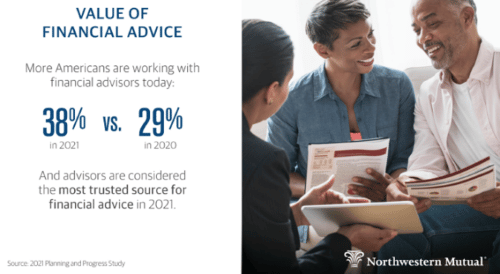

The study also showed an increase in those seeking financial advice to help guide them through the storm. This is understandable as there are many things to consider going forward and reworking retirement plans may be in order. Here are 5 ways that we are helping our clients navigate their post pandemic road to retirement.

Our first step is to talk with our clients about their retirement goals and whether those goals have changed as a result of the pandemic. If our clients are unsure, we help them analyze their current situation based on what we know now. We also proactively address how the unexpected (like a pandemic or health issues) could cause them to retire earlier than planned and how that could affect our retirement strategies.

Next, we determine if we need to adjust our clients’ asset allocations based on how the pandemic has affected their retirement goals. This is somewhat dependent on age (younger clients’ asset allocations are less likely to need adjusting due to the time factor), how close they are to retirement and stock market volatility.

It’s critical to plan carefully for the best time to start claiming Social Security retirement benefits. Of course, the longer clients wait to start receiving benefits, the higher their monthly benefit payments will be. If our clients’ goals change to retiring earlier or later, we revisit our Social Security distribution strategy as it is directly correlated to the age at which they decide to take it.

Some of our clients received early retirement offers as a direct result of the pandemic. In this situation, we partner with our clients to help them understand the offer and the financial impact of accepting it or not. For example, how much does the total payout compare to continuing to work for a certain number of years? Does the package include a lump-sum cash payout or annuity payments over a period of time? Is their job security at stake if they do not accept the package?

Another important question is whether the package will allow our client to remain on the company’s healthcare plan? If it does, how much are the monthly premiums? This is especially critical depending on the client’s age.

We believe that it is critical for health care costs not to be overlooked in retirement, especially if our clients are retiring before they are eligible for Medicare (65 years old). We feel so strongly about this that we work with a 3rd party expert to help our clients shop for healthcare coverage and compare options. This is tricky business with employer plans vs. COBRA vs. government health care exchange with or without government subsidies. Expert advice is warranted here!

It’s a crazy world out there, and we are here to help add value to our clients’ lives, goals, and dreams. It’s no wonder that more Americans are working with financial advisors for guidance in these complicated times. Here at Virtus Wealth Management we partner with our clients throughout their lives (ups, downs, pandemics) to help them confidently navigate along the way to their final (all be it possibly changing) destination and enjoy the ride!

The opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss.