There are several proposals to address the Medicare funding crisis, aiming to ensure the program...

It’s hard to believe that tax season is here already. In an effort to help our clients be prepared, we wanted to make sure you are informed of important dates and items to consider when preparing to file your taxes.

Don’t worry – you won’t need to have a tax law degree to follow what changes could affect you this tax year. The biggest change most individuals will see this year is the inflation adjustments.

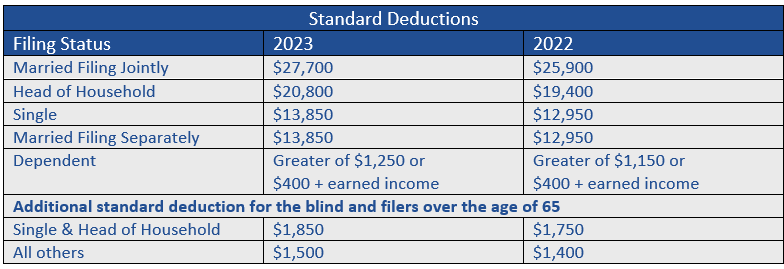

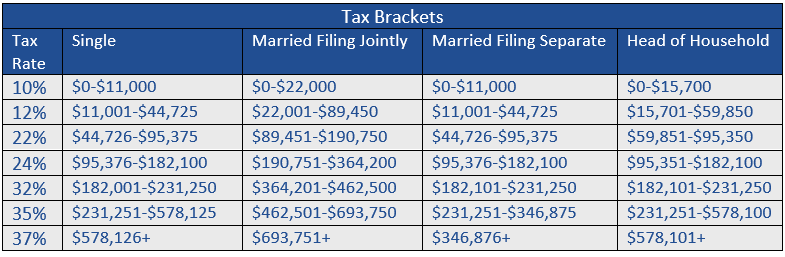

When comparing tax year 2022 to 2023, there was roughly a 7% increase in the tax brackets. So, while there are still seven tax brackets and the rates at each did not change, the amount of taxable income you can have in each bracket expanded larger than normal. The standard deduction also increased slightly. We have provided the tax brackets and standard deduction amounts below.

Many energy tax credits are still in play. If you installed energy efficient home improvements (such as new windows, insulation, solar panels, furnace, hot water heater, or central air conditioning) or if you purchased an electric vehicle (new or used) ask your tax professional about the credits you may qualify for.

It is never too early to start planning for tax season. If you are in need of a tax preparer, Prestyn runs Virtus Tax Strategies and would be happy to help you. If you have any questions, please contact Prestyn at (817)717-3812 or ptillotson@virtuswealth.com.

Once again, the IRS delayed reporting changes for business income received via payment apps. Over the last few years, you may have heard rumors about a new tax law that would have triggered you to receive Form 1099-K if you received more than $600 from any third-party payment service, such as Venmo, PayPal, Etsy, Facebook, or CashApp.

This law was originally taking effect in January 2023 when you would receive Form 1099-K reporting any business income over $600 brought in throughout 2022. Form 1099-K applies to business transactions, such as part-time work, side jobs, or selling goods. It is not intended to apply toward personal transactions. However, due to confusion and concerns regarding the implementation of this new law and lower threshold amount, the IRS announced another delay to that Form 1099-K rule change. This means the 2021 threshold amounts will generally apply for the 2023 tax year and that you should only receive Form 1099-K if you received more than 200 business transactions worth an aggregate above $20,000.

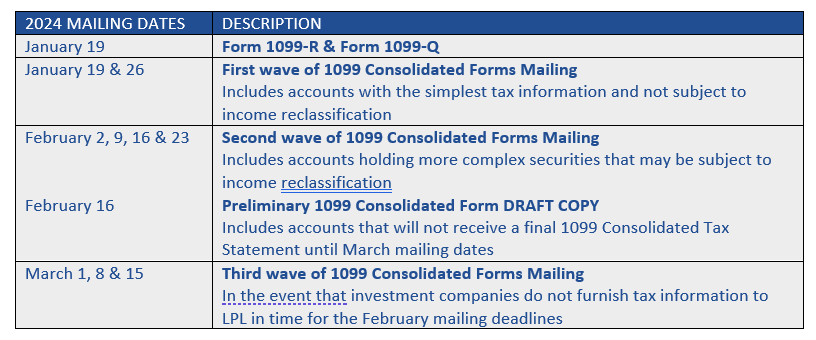

The LPL mailing schedule for your tax statements is listed below. In order to meet all IRS deadlines, reduce errors, and reduce the need to mail corrected versions, 1099 Consolidated statements will be mailed in phases. Timeliness and accuracy remain a priority.

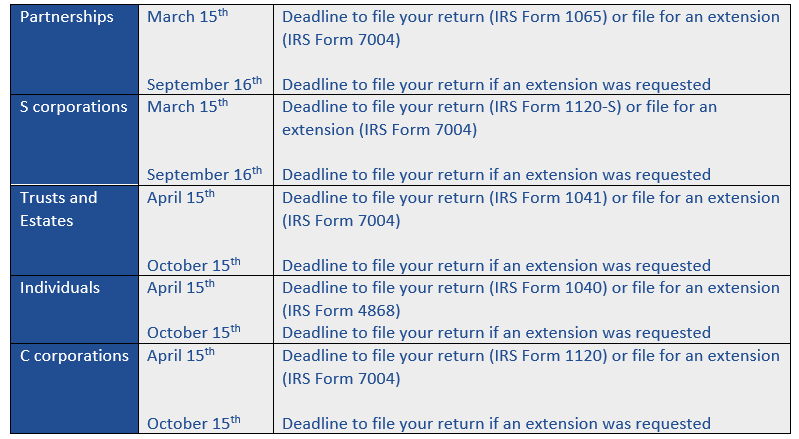

The following deadlines are for calendar year filers. The deadlines for partnerships and corporations that follow a fiscal year calendar vary, consult your tax professional for more information.

The standard deductions for 2023 federal taxes filed in 2024 are reflected in the chart below. Note the additional standard deduction applies to each spouse, so if both spouses are over the age of 65 (and not legally blind) their additional standard deduction is $3,000.

The chart below reflects the 2023 federal income tax brackets for taxes due in 2024.

Here are some important items to consider as you begin receiving your tax documents.

Schedule K-1’s are used by pass through entities to document income distributed to you during the tax year. So, you will receive a K-1 if you are a partner or shareholder in a pass-through entity (like a Master Limited Partnership). Realize, too, that you might receive a K-1 form if you are invested in a fund or an Exchange Traded Fund that operates as a partnership.

The tricky part for you with a K-1 is timing. Unlike 1099 and W-2 forms, which are typically sent to the taxpayer by the end of January (mid-February at the latest), a K-1 isn’t due until mid-March because businesses need more time to file their tax returns.

Please be aware that you may receive a Corrected 1099 after your initial 1099 due to income reclassification. Income reclassification refers to changes that security issuer companies (such as outside banks and institutions) make to all or part of previously reported distribution income to some other tax classification. Your annual 1099 tax statement reports are received from these outside issuer companies. After issuers complete year-end audit and reporting processes, this information may change, which is referred to as income reclassification. This information is then applied to accounts that are impacted by the securities changes and a new 1099 statement is generated and mailed in the next correction mailing.

Similar to other major financial firms’ standard protocols and delivery, 1099 Consolidated statements are mailed in waves as information is received from various institutions. For certain security types, final tax information from the bank, institution, or other type of issuer may be received after the standard deadline, resulting in your statement not arriving on the anticipated February date. In these cases, the statement will be mailed on March 15, March 22, or March 29, 2024. However, they can be mailed as late as October 4, 2024.

Tax statement corrections due to income reclassifications are more likely for certain investments including:

— Regulated investment companies (mutual funds)

— Unit investment trusts (UITs)

— Real-estate investment trusts (REITs)

— Widely-held fixed investment trusts (WHFITs)

Unfortunately, there’s no IRS cutoff or deadline for providing corrected 1099 forms. If you need to file an amended tax return, it’s recommended that you discuss the situation with your tax advisor prior to refiling so you can determine the best course of action based on your individual circumstances.

Note: Reclassification is an industry-wide activity. All financial industry firms receive reclassified data from the issuers.

It’s always a good idea for you to maintain an open line of communication with us and your tax advisor throughout the year in order to ensure appropriate tax strategies. This dialogue can help you decide if filing an extension is the best course of action. There are many reasons why filing an extension might make sense. For example, the volume of data or complexity of certain transactions inside or outside your accounts may require additional time to address. Also, if you are expecting to receive your 1099 in the fourth mailing wave in March, it may be reasonable to consider filing an extension to allow sufficient time for their tax advisor to accurately complete their tax return forms.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.