The question of Medicare sustainability is in tandem with Social Security sustainability. Both...

It’s hard to believe that tax season is here already. In an effort to help our clients be prepared, we wanted to make sure you are informed of important dates and items to consider when preparing to file your taxes.

For three years, the IRS has struggled with a backlog of work. During the first quarter of the 2022 calendar year, the IRS focused on reducing its correspondence backlog, which left most phone calls from tax payers unanswered. The IRS also prioritized processing its backlog of returns from 2021, but then had more than 12.4 million returns from 2022 to process as of late September.

The IRS subsequently hired thousands of new employees in the hope of being better prepared for the 2023 tax filing season. However, the IRS recently warned taxpayers not to bank on getting their refunds by any specific date when they file their returns in early 2023.

Many different factors can affect the timing of a refund after the IRS receives a return. Although the IRS issues most refunds in less than 21 days, some returns may require additional review and may take longer to process if IRS systems detect a possible error, the return is missing information or there is suspected identity theft or fraud. There are important steps you can take to help ensure that your tax return and refund do not face processing delays. The IRS recommends that you file your return electronically and opt for direct deposit or online payments instead of mailing a check.

This is the first year since the pandemic when financial relief has slowed down, so many tax credits and deductions are reverting back to where they were in years prior. While numerous tax code proposals were discussed and failed to pass Congress in 2022, two provisions did pass: the Inflation Reduction Act approved in August 2022, and the Secure 2.0 Act approved in December 2022.

This document includes information on the tax law changes that may impact your 2022 tax return. We will continue to provide timely updates on any new changes or updates that may impact your tax situation.

If you have any questions, please give our office a call at (817)717-3812 or email Prestyn at ptillotson@virtuswealth.com.

Eligible homeowners could qualify for a 30% tax credit for adding solar or wind powered systems to their homes. Additional tax incentives are also included for the purchase of energy-efficient water heaters, heat pumps, and HVAC systems. Rebates for these items can add up to as much as $14,000 and take effect immediately. This credit will be in effect until 2032.

Existing tax credits for the purchase of a new electric vehicle are extended through December 2032. The credit applies to any “clean” vehicle, including hydrogen fuel cell cars within price limits. To qualify, vehicles must be assembled in North America and be priced under $80,000 for trucks and SUVs and under $55,000 for all other types of cars.

Qualified buyers of new vehicles receive a $7,500 credit, applied at the point of sale. A new $4,000 tax credit would also apply for the purchase of qualified used electric vehicles. The credit is available to married couples filing a joint return with income less than $300,000 per year and single tax filers with income under $150,000. The credits are effective immediately, but starting in 2024, qualifying vehicles must meet other requirements for American-made components, including batteries.

You will no longer be able to claim an above-the-line deduction for charitable contributions if you claim the standard deduction. Now you will only receive a tax break for charitable contributions if you itemize your deductions.

Congress gave charities a boost in 2020 and 2021 by allowing individuals to claim a deduction up to $300 for cash donations ($600 for married filers), regardless of whether you itemized or took the standard deduction. However, this tax break was not extended for the 2022 tax year.

You may have heard rumors about a new tax law that would have triggered you to receive Form 1099-K if you received more than $600 from any third-party payment service, such as Venmo, PayPal, Etsy, Facebook, or CashApp.

This law was originally taking effect in January 2023 when you would receive Form 1099-K reporting any business income over $600 brought in throughout 2022. Form 1099-K applies to business transactions, such as part-time work, side jobs, or selling goods. It is not intended to apply toward personal transactions. However, due to confusion and concerns regarding the implementation of this new law and lower threshold amount, the IRS announced a delay to that Form 1099-K rule change. This means the 2021 threshold amounts will generally apply for the 2022 tax year and that you should only receive Form 1099-K if you received more than 200 business transactions worth an aggregate above $20,000.

For the 2022 tax year, this credit returns to the original amount of $2,000 per child age sixteen or younger. This amount applies to all children with no higher credit for children under the age of six. This credit is partially refundable up to $1,500 and begins to phase out if your 2022 modified adjusted gross income exceeds $400,000 for married filing joint ($200,000 for single filers).

In 2021 and only for the 2021 tax year, the American Rescue Plan Act (ARPA) increased this credit amount to $3,600 per child under the age of six and $3,000 per child sixteen years or younger. Additionally, the ARPA provided advance payments of this credit to be automatically distributed to qualifying taxpayers as well as made the credit fully refundable. Both changes were also only for the 2021 tax year.

Families with dependents who do not qualify for the Child Tax Credit may be able to claim the $500 non-refundable Credit for Other Dependents (ODC). We recommend that you speak to your tax professional about the qualifications for each credit.

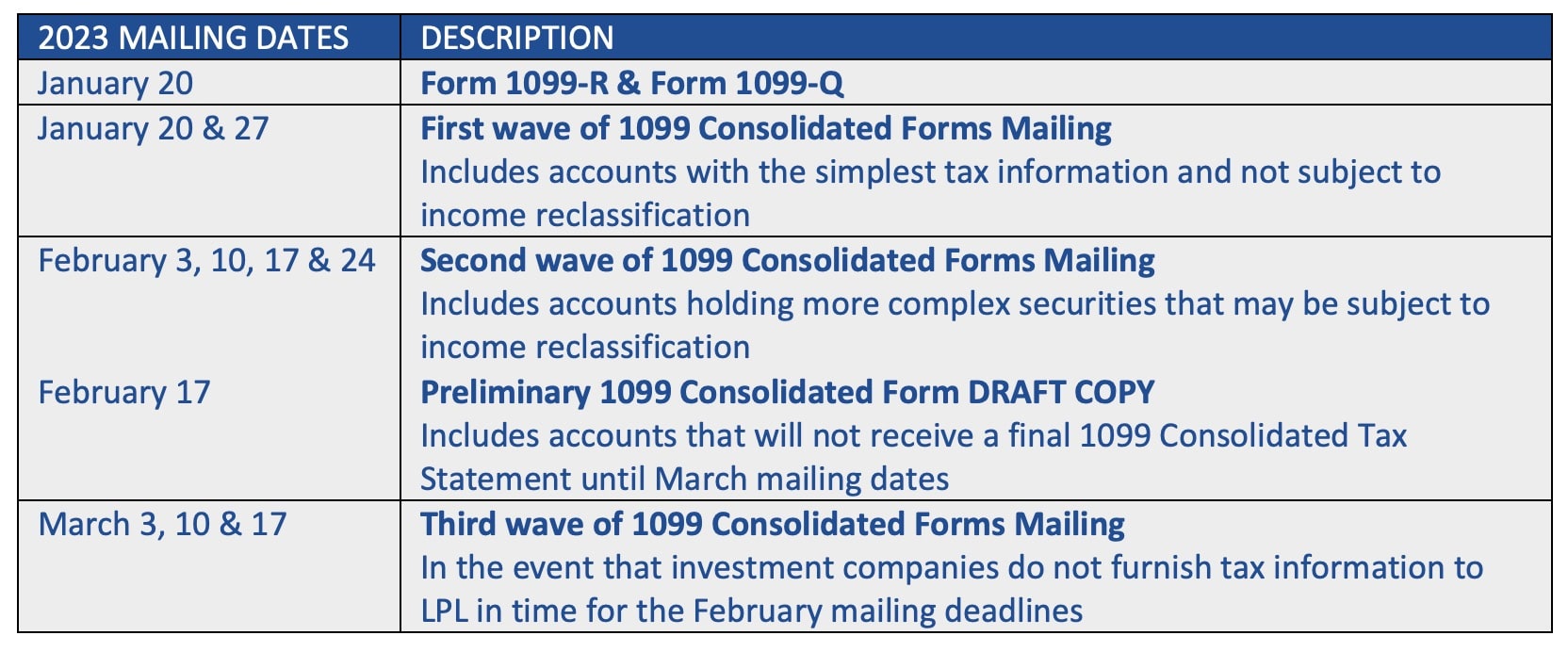

The LPL mailing schedule for your tax statements is listed below. In order to meet all IRS deadlines, reduce errors, and reduce the need to mail corrected versions, 1099 Consolidated statements will be mailed in phases. Timeliness and accuracy remain a priority.

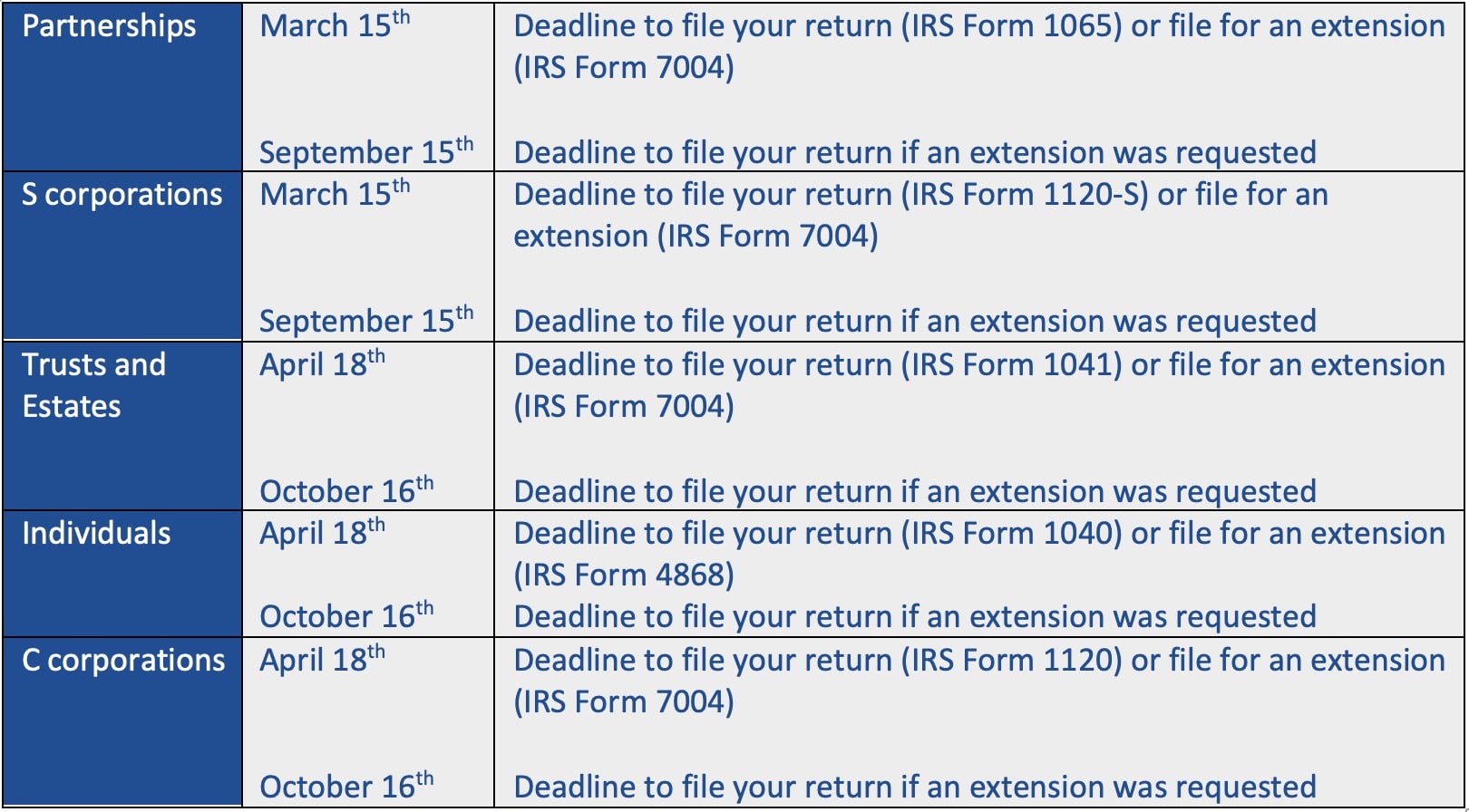

The following deadlines are for calendar year filers. The deadlines for partnerships and corporations that follow a fiscal year calendar vary, consult your tax professional for more information.

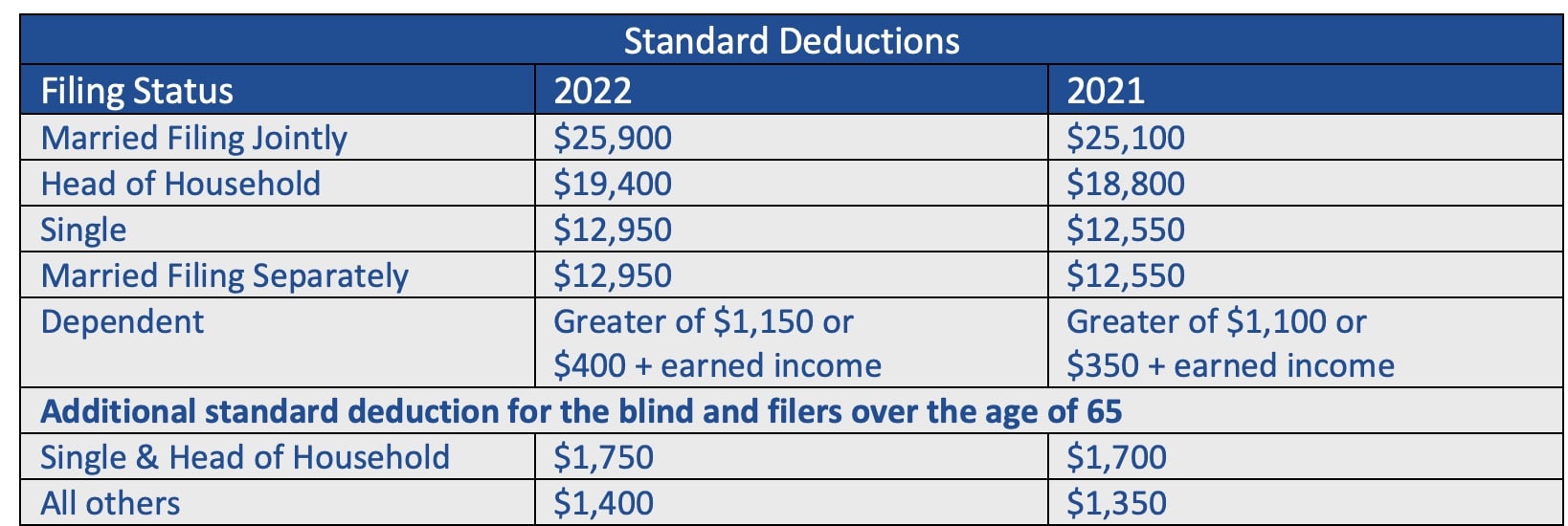

The standard deductions for 2022 federal taxes filed in 2023 are reflected in the chart below. Note the additional standard deduction applies to each spouse, so if both spouses are over the age of 65 (and not legally blind) their additional standard deduction is $2,800.

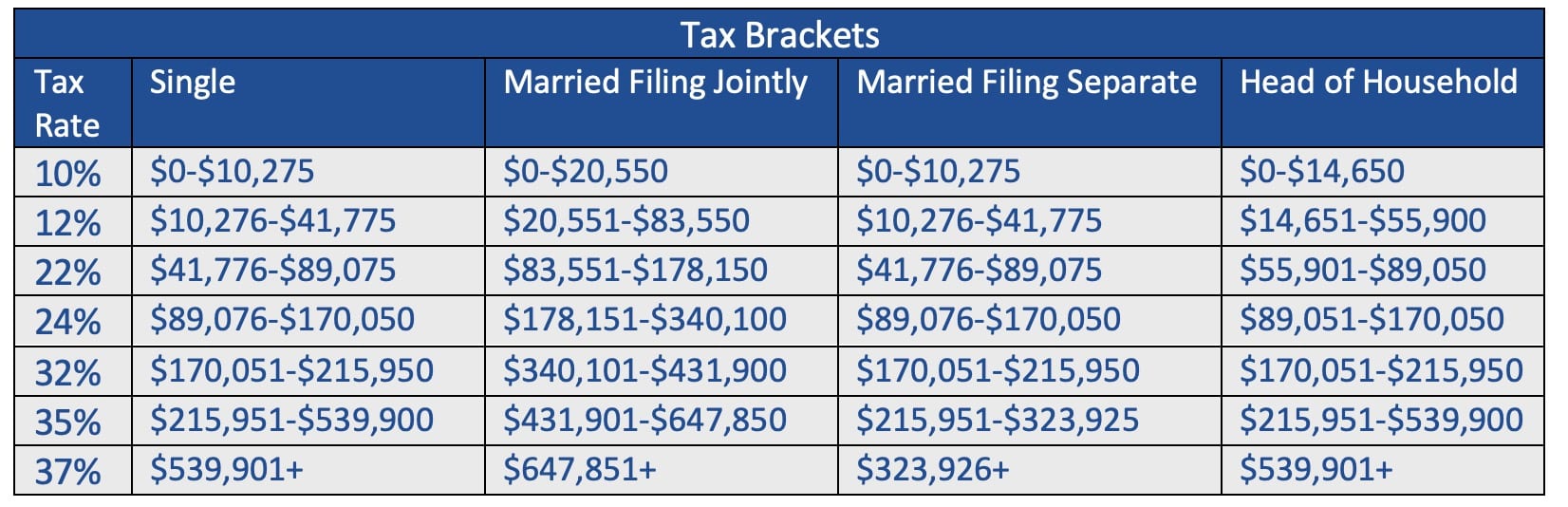

The chart below reflects the 2022 federal income tax brackets for taxes due in 2023.

Here are some important items to consider as you begin receiving your tax documents.

We hope this information is helpful as you prepare for completing your taxes. If you have any questions, please reach out to Prestyn in our office at (817)717-3812.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.