In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

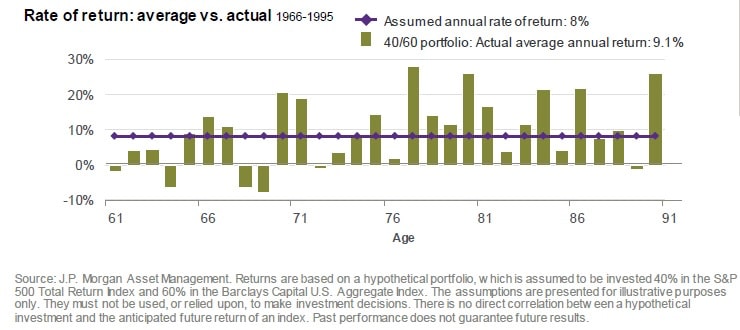

Relying on averages can be dangerous. Brian’s dad had a saying, “You can drown in a river that averages 3 feet deep.” Using averages can be risky, and applies to retirement planning too.

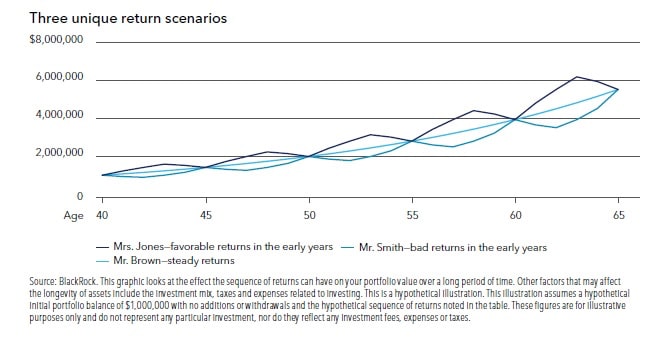

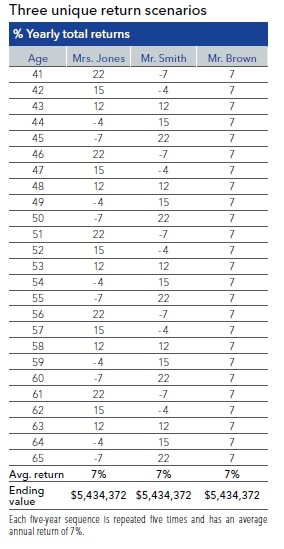

During the accumulation phase of retirement planning, the impact of sequence of returns can be minimal (See Charts Below).

Three investors made the same initial hypothetical investment of $1,000,000 at age 40 with no additions or withdrawals.

All had an average annual return of 7% over 25 years. However, each experienced a different sequence of returns.

At age 65, all had the same portfolio value, although they had experienced different valuations along the way.

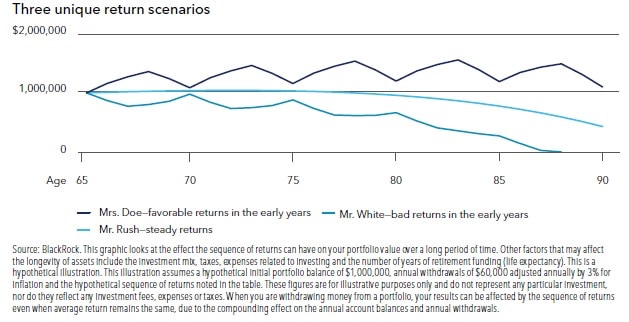

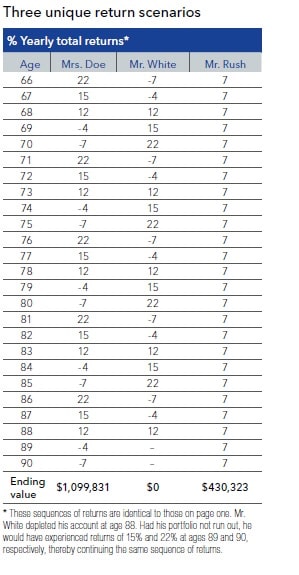

During the withdrawal phase, it’s a different story. The sequence of returns can have a critical impact on portfolio value due to the compounding effect on the annual account balances and annual withdrawals (See Charts Below).

Withdrawing assets in down markets early in retirement can ravage a portfolio. How do you counter your Sequence of Return risk? Here at Virtus Wealth Management we use several techniques including considering a dynamic approach to spending and strategies that incorporate downside risk management. There is one thing for certain … the market does not work in averages (see final chart below); we help our clients proactively prepare accordingly.

No strategy assures success or protects against loss. Investing involves risk including loss of principal.

Some of this material was prepared by Blackrock.