It’s hard to believe that tax season is here already. In an effort to help our clients be...

Saving versus Investing. What’s the difference?

Did you know that the typical person spends more time planning for vacation than planning for retirement? Does it surprise you? Probably not. It’s understandable. Planning for retirement can be overwhelming. It involves decision, math, and emotions. Yikes!

At Virtus Wealth Management, it’s our job to stay grounded and simplify the complex. Retirement planning may start with your 401k, but it goes well beyond that. It can help you manage market risks, learn the difference between being a saver and an investor, manage longevity with planned income, and proactively address your future healthcare needs. That’s a biggie. Healthcare encompasses the known and the unknown. It’s likely that a healthcare event is coming (aka the known), but it’s unlikely that we know what the healthcare event will be (aka the unknown). Planning is key.

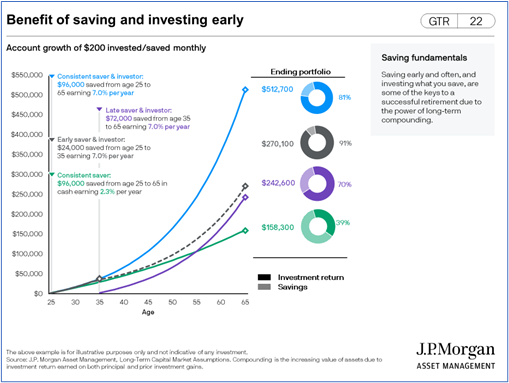

Let’s start with the saving versus investing concept. It’s reasonable for cash to earn 2-3% and for a balanced portfolio to earn 7% over the long term. You may be thinking, “Well, that’s not that big of a difference, and my money is safe in cash”. Let’s just bust that thought right now. IT IS A BIG DIFFERENCE OVER THE LONG TERM!!! As Einstein said, compounding is the 7th wonder of the world. It makes a huge difference to be an investor versus a saver. See the chart below.

So, how do you begin? Save early. Save often. Build your emergency savings first. Maximize the benefits in your workplace. Take full advantage of matching and view your 401k as “hands off” until you retire.

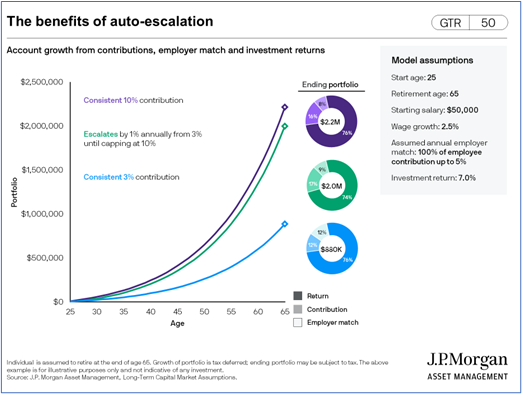

Start small and build on it. You don’t have to run a marathon to get started running, right? You can take it one step at a time, one training plan at a time, and work up to it. The illustration below shows that starting early with 3% contributions per year and increasing them by 1% per year (with raises, cost of living adjustments, etc.) until you reach 10%, almost has the same effect as contributing 10% right away. How do you eat an elephant? One bite at a time.

Focus on what you can control. Your saving. Your spending. Your investing. Then, expand from there. Let us help you build a customized plan for you. Hold yourself accountable, and you will be running your marathon in no time too. Virtus Wealth Management is here to support and partner with you every step of the way.