The question of Medicare sustainability is in tandem with Social Security sustainability. Both...

You may be:

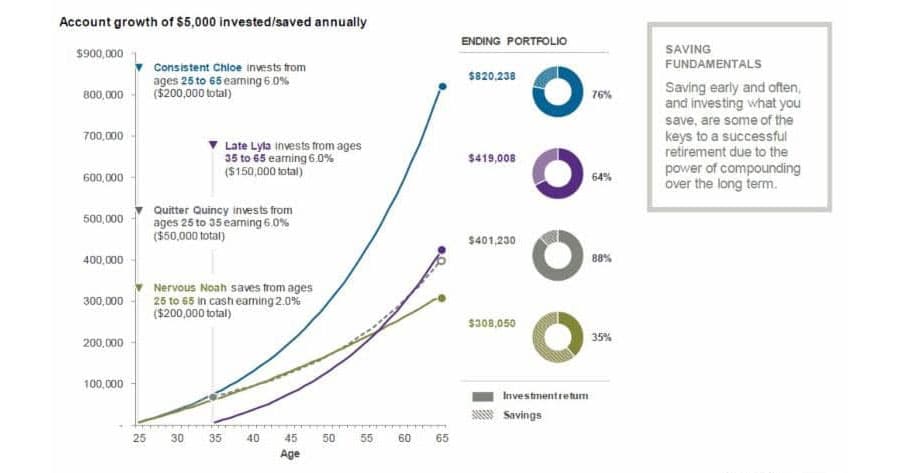

Some good news: not only are 86% of millennials saving money, per a Bankrate.com study, they are starting their savings 10 years earlier than any other generation. However, more than 60% lack the confidence that they have the knowledge to invest wisely, per a Capital One 2016 study. The best way to overcome lack of confidence and become more confident is taking action. Start today… the earlier the better! Get advice, start small, be consistent, and think long-term.

Wealth management is more than just financial advice. You benefit from working with a financial advisor to coordinate and unify the decisions in your financial life, so that those decisions complement each other and produce enhanced results. By bringing all the various pieces together we will create a tailor-made, stress-tested plan that ensures you are confident in your financial future.

It’s never too late to start working with a financial advisor. There are no pre-requisites, no education or financial literacy requirements that you must have before you start working with a financial advisor. Our advisors have the degrees, the training and the years of experience in this field in order to provide you with the facts needed to make the right choices for you and your family. Join a community of individuals who are, or want to be, educated, empowered and involved in the planning of their financial futures.

Start with a plan. If you are wondering where to start, it’s with a stress-tested financial plan. Per a Palo Alto Software study in 2016, a business is twice as likely to be successful if it has a written plan. Why are we talking about business planning? Your retirement is your business and you are the founder and CEO. Knowledge and planning are your path to empowerment. Read more about our plan and process here.

Build Your Wealth. What is a financial advisor worth? Interestingly enough, behavioral coaching provides the largest value to clients at 1.50% basis points of return per year, per The Vanguard Group research study. We can help you build your wealth by keeping you on track to meet your goals, keeping the market in perspective and mitigating risk. Here are some resources to get you started:

Myth Busters: Millennials and Finances

What Is The S&P 500 Index and Why Is Everyone Talking About It?

As an added bonus, access our Risk Tolerance Quiz to quantify your risk to truly understand how much risk you are taking in your portfolio.