In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

Have you ever wondered what risk tolerance means? What is the difference between a Conservative Portfolio vs. a Moderate Portfolio vs. an Aggressive Portfolio? Aren’t those terms subjective? A conservative portfolio to one person may be an aggressive portfolio to another, right? What if we could quantify a portfolio’s risk with a range for potential loss to allow you to understand the financial impact of risk?

At Virtus Wealth Management, we have a process that does just that. Understanding objective drawdown limits and ranges of return expectations help us help our clients to understand the financial impact of risk, and it keeps us all on the same page.

Investment returns are not linear. While any portfolio may have an average annual historical return, every year is different. When a portfolio is on its intended track, the expectation for any rolling time frame, for example, the next six months, should have a range of returns from negative to positive.

Our portfolios have stated risk objectives and are manage accordingly. This clearly defines the range of expectations for our clients on both the downside and upside at a 95% probability for the next 6 months. It is absolutely critical for us that our clients explicitly understand the risk / reward relationship and the fact that they can’t have one without the possibility of the other!

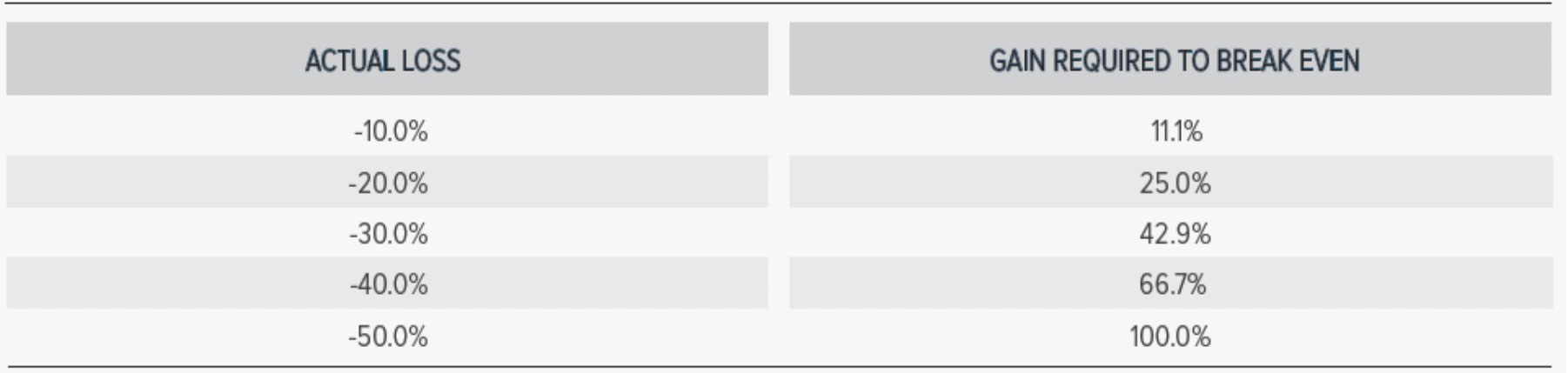

As such, we believe avoiding loss of principle is a primary component of success as the percentage gain required to break-even is higher than the percentage loss (see table below).

Do you know how much risk you are taking in your portfolio? Do you want to better the downside / upside risk relationship to quantify the risk that you are willing to take to reach your goals? If so, please get started today by Rating Your Risk. We are here to help!

The information provided here is for general information only and should not be considered an individualized recommendation or personalized investment advice.

All investing involves risk including loss of principal.

No strategy assures success or protects against loss.

Past performance is no guarantee of future results.