In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

You may be:

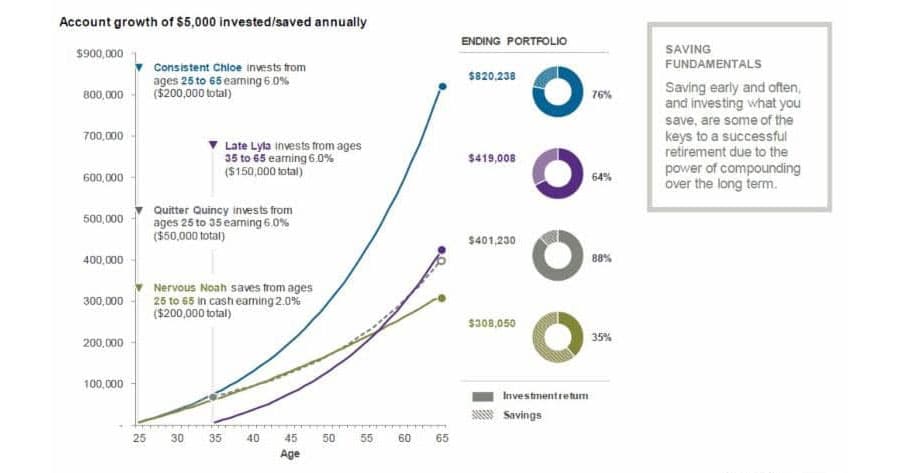

While it’s great that 74% of workers are saving for retirement, only 41% have tried to calculate how much they will need to save in order to meet retirement income expectations.1 There is more to retirement planning than simply setting aside savings. This is a time of escalation when the years start flying by faster, the cars and homes get nicer, while your income and expenses both keep increasing. This is also a time when the financial decisions you make will have the greatest impact on the lifestyle you enjoy during retirement.

As a holistic wealth management firm, our advisors take a macro look at your finances. While you may already have many micro-managers such as your Banker, Attorney, Accountant, Insurance Agents and Real Estate Agent, these managers typically only focus on their relatively small role in your overall wealth management plan. How do you know that an action or recommendation from one manager works efficiently with the action of another?

A wealth manager can help by creating a financial plan that aims to keep your financial goals in focus, even as life grows more complex and priorities shift. We look at the big picture and bring together all of the various pieces that make up your finances. By organizing and unifying those various pieces, we work to ensure that your money is working efficiently, that there are no overlaps or anything missing, so you stay on track to meet your goals and ultimately build sustainable long-term wealth.

What Is The S&P 500 Index And Why Is Everyone Talking About It?

Retirement Planning is Different For Women

Solidify your plan. Whether you have a professionally tailor-made plan or just an idea in your head, we can help transform your plan into a physical resource that you can confidently turn to when making decisions that impact your financial future. This process involves collecting your financial information; discussing your goals and concerns; reviewing your current status relative to your goals and concerns; providing recommendations and options that seek to improve your financial status; implementing any recommendations you may choose in the most cost-effective manner possible; and performing periodic reviews and analysis.

Your financial responsibilities and concerns are likely changing as you, your family, and your assets grow. Our financial advisors are there with you every step of the way. We partner with you to ensure that you feel educated, empowered and involved in the planning of your financial future.

Worrying about where the stock market is going or when it is going to crash is really like trying to solve an algebra equation by chewing bubble gum. The stock market’s behavior is cyclical and bull markets do not last forever. However, the real question is NOT when the next market correction or crash will happen (no one knows). You can’t control the markets, you can’t time them, so what can you do? You can make sure you know the possible loss in your portfolio if the market were to drop 25% tomorrow and then make sure it doesn’t destroy either your shorter or longer-term goals.

Your financial advisor can help quantify the risk level within your stock portfolio. We go beyond the stereotypical terms (‘conservative’ vs. ‘aggressive’ etc) so your risk becomes something tangible. You can rest easy knowing that whichever direction the market moves, your portfolio should stay within a range that keeps you on track to meet your long-term goals. If you already work with a financial advisor or money manager, do you truly understand how much risk you are taking in your portfolio?

Additionally, risk management involves more than just your investment risk. Our advisors strive to protect you and your loved ones from all aspects of risk, including the possibility of serious illness/injury or death. Our independent financial advisors can provide impartial recommendations or options regarding all forms of insurance – notably, life, disability, long-term care, and umbrella policies. Here are a few resources to get you started:

There’s Life In Life Insurance

A Potentially Big Financial Mistake

What Is A Portfolio Stress Test And Why Is It Important?