It’s hard to believe that tax season is here already. In an effort to help our clients be...

In the last Virtus View (Importance of Guaranteed Income), I said, “It is critical not to under-estimate your life expectancy when attempting to maximize your social security benefits. It is highly likely that you will live longer than you think!”

The emphasis on longevity is worth repeating.

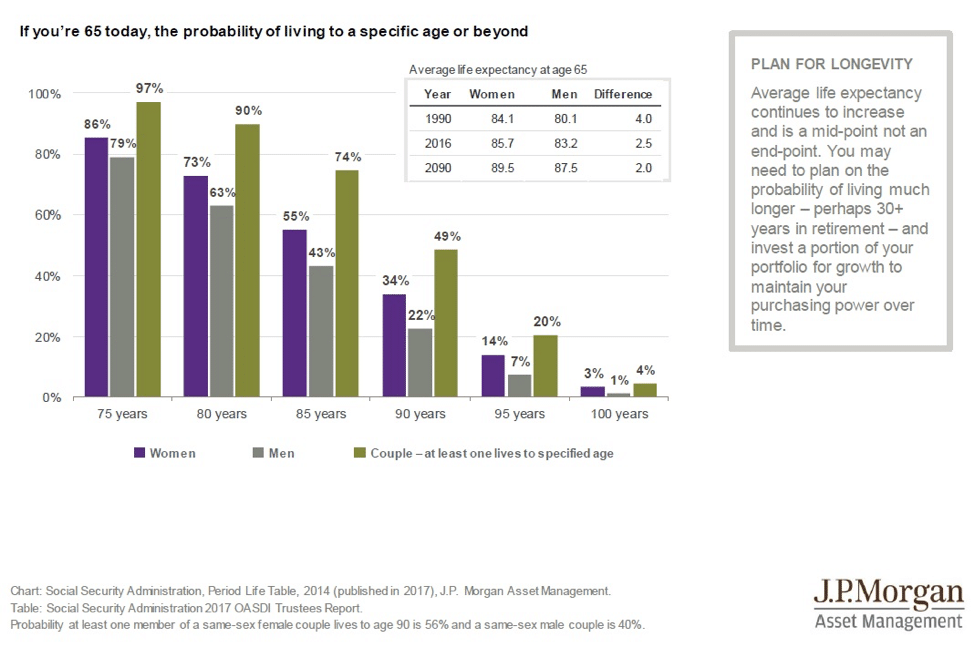

First, life expectancy has increased over the years due to medical advances, etc. The question is, by how much? According to the Centers for Disease Control and Prevention, the average life expectancy of a 65-year-old male is 6 years longer now than in 1950, and the average life expectancy of a 65-year-old woman is 5 years longer now than in 1950.

Those are just averages. Let’s take it a step further and consider the probabilities. An average is just a mid-point. For averages, one-half will die before life expectancy, and the other half after. So, the better way to approach the problem is to consider the probability of living to certain ages (see chart below).

Planning is important, and planning with the right variables is even more important. We are here to help you develop your retirement plan with confidence.