In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

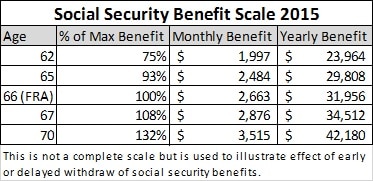

Social Security is one of the largest assets that retirees have today. The maximum social security benefit at full retirement age (FRA, currently age 66) for 2015 is $2,663 per month, $31,956 per year. This is a vital income stream in nearly every financial plan and, as with many government programs, can be fairly complex. There are several options on when and how to draw social security, and choosing the right options for your specific financial situation could be the difference of hundreds of thousands of dollars! With that said, let’s take a closer look at social security benefit options and strategies

Information for this chart was obtained from the Social Security Administration website (http://www.ssa.gov)

As you can see based on the above chart, drawing your benefit early means you receive 75% of your full monthly benefit; however by delaying taking your benefits after FRA your monthly benefits increase 8% each year. This allows you to increase your monthly benefit to 132% of the maximum benefit amount. However, just because you receive more money per month by waiting until you are age 70 does not mean that is the best option for everyone. One must consider current income needs and life expectancy when attempting to optimize their social security strategy.

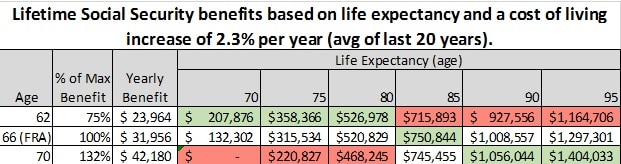

The following chart is an illustration of the total maximum social security benefit based on the age you begin taking social security and how long you expect to receive benefits. The total benefit includes a cost of living increase each year of 2.3% which is the average adjustment that the Social Security Administration has made over the last 20 years. The green shaded boxes show the option that hypothetically maximizes your total social security benefits received based on the corresponding life expectancy. The red, however, shows the option that would generate the least total benefit of the 3 options listed. Keep in mind, the average life expectancy of a 66 year old male in 2015 is 84.6 years, 86.8 years for females.

Information for the chart above was obtained from the Social Security Administration website (http://www.ssa.gov).

This chart shows, all else equal, the effect of life expectancy and social security start date on your total lifetime social security benefit. It is very important to note that this does not take into account your tax bracket, current income needs and should only be used to illustrate that there can be substantial difference in total benefits between options. Also remember this chart depicts the maximum social security benefit an individual can receive in 2015. To estimate your Social Security benefits log in to the Social Security Administration’s website; there is a link to this page on the “Resource Links” section of the Virtus Wealth Management website, www.virtuswealth.com.

If this wasn’t complicated enough already, there are also a few strategies that married couples can implement to further maximize their total social security benefit.

One that can potentially have a great benefit is “file and suspend.” This is where the primary wage earner at full retirement age (66) will file for their benefit then immediately suspend receipt of those benefits. It sounds like an odd thing to do, but this allows their spouse to begin drawing his/her spousal benefit while continuing to grow both of their benefits 8% a year until age 70 as illustrated in the chart above.

For example, say Joe and his wife Susy are 66 years old, retired and are in very good health with good family health history. Joe was the primary wage earner and will receive the maximum social security benefit, Susy also worked and is entitled to her own benefit of $2,000 per month based on her top 35 years of employment. Joe can begin drawing his $2,663 per month now but since he is very healthy and does not need the income now he delays receiving his benefit so he can receive $3,515 per month starting at age 70. He files and suspends and Susy files for her spousal benefit of $1,331 (50% of Joe’s at FRA) while her benefit continues to grow to $2,640 per month (132% of $2,000). Allowing Joe’s benefit to grow to age 70 is important because if he were to pass away, Susy will receive the larger of his or her benefit for the rest of her life. If Joe and Susy were to live to age 90, implementing the file and suspend strategy versus simply each drawing social security at age 66, they increase their total social security benefit received by over $680,000. That is an astounding number, but keep in mind there is no guarantee this will turn out to be the best strategy for them, if they were to not live as long as they thought perhaps another strategy would have been optimal.

There are a few other strategies that can be implemented in an attempt to optimize your total social security benefits but for the sake of time and length of this article we will not discuss them. The point is, social security is very important to your financial well-being and picking the right option and strategy for you is equally as important. I urge you to spend time thinking about your situation before taking your benefits and allow the professionals here at Virtus Wealth Management help determine which option will optimize your financial plan.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual, nor intended to be a substitute for specific individualized advice.