In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

Did you know that although the S&P 500 was up over 25% last year, it is only up a little over 3% from the beginning of 2022 to the end of 2023? How about even considering all the press the growth and tech stocks received for the performance in 2023, the QQQs, which is an index of primarily growth technology firms, was also up a little over 3% over the same period.

What a roller coaster though, right? The question is, was it necessary? VTV, which is a large cap value index fund, was up over 6% over that same time frame. Even better, for those taking distributions, it performed better with less volatility. As the Navy Seals mantra goes, slow is smooth and smooth is fast. I know it isn’t exciting, but it isn’t as nerve challenging either.

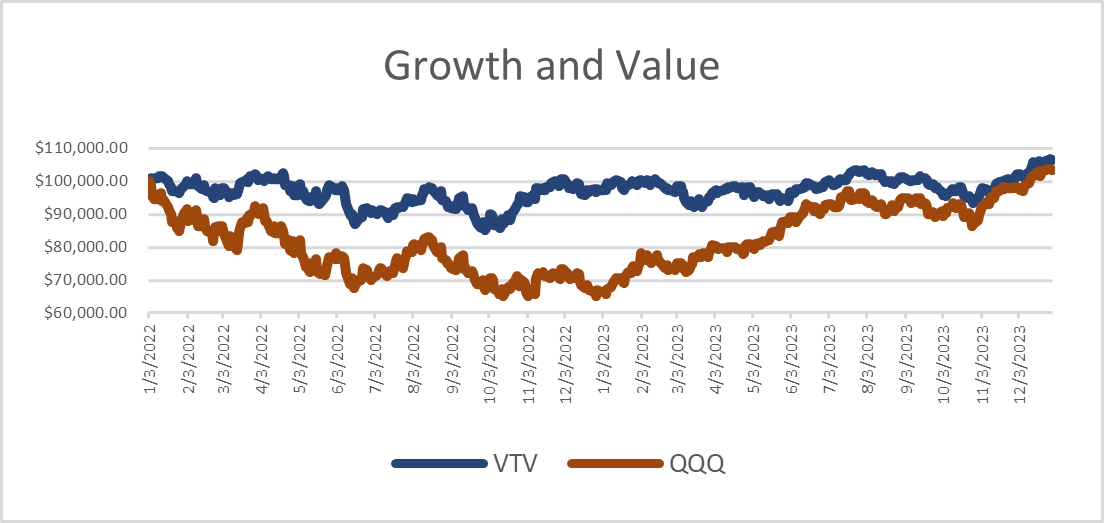

Following is a chart of both VTV and QQQ returns if you invested $100,000 the first day of that two-year period:

Source: Yahoo Finance

As you can see, one is a lot less volatile than the other, however even after all the press tech stocks received, they basically end in the same place. Now one might accuse me of cherry picking my periods. Here is the same chart from the beginning of 2021, again a good year for both the S&P 500 and technology stocks, to the end of 2023. Two good years sandwiching a bad year.

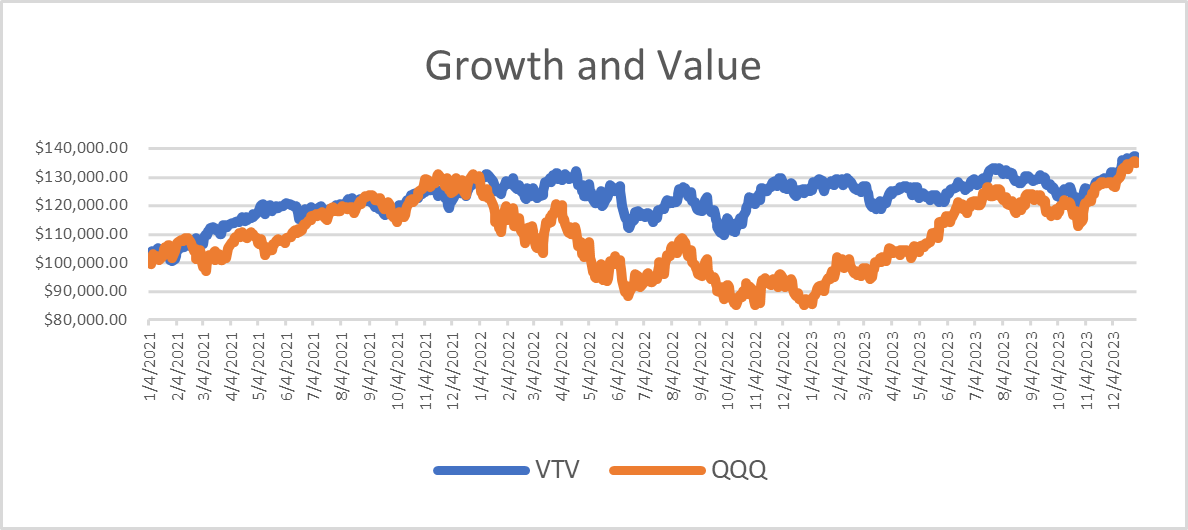

Source: Yahoo Finance

If you invested $100,000 in each fund, after the three years you would have more money in the VTV portfolio. You can see the difference in volatility. I do recognize that if one goes back 7-8 years, growth has outperformed. I am not suggesting one invest 100% in value stocks nor I am suggesting one is better right now. I am a firm believer in diversification and having both value and growth stocks in a portfolio. What I do want to stress is the importance of getting off the roller coaster if you need distributions from the portfolio for living expenses and not to just assume growth stocks are the better investment just because a handful of growth stocks have got all the attention over the past several years.

As a reminder, if you lose 20%, it takes more than a 20% gain to get you back to even. If you start with $100k and it drops to $80k, you need a 25% gain to just get back to $100k. However, if you are also taking out $5k for living expenses, you now need approximately a 33% gain to get back to even. You could end up in a stairstep pattern downwards in your portfolio.

Bottom line, there is nothing wrong with “slow is smooth and smooth is fast” in investing, especially if you need distributions. It might not be exciting, but it also doesn’t stress the nerves nearly as much.