For our retired and pre-retirees, I wanted to share some insights to the cost of healthcare in the...

Are you sure you truly understand the risk you are accepting? What should you expect your downside losses to be if you desire a 6%, 8%, or 10% return? Have you ever tested your risk level?

Are you sure you truly understand the risk you are accepting? What should you expect your downside losses to be if you desire a 6%, 8%, or 10% return? Have you ever tested your risk level?

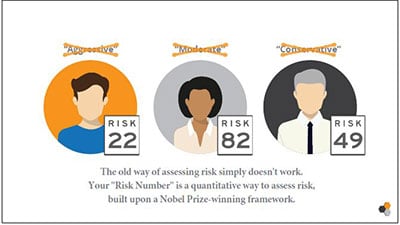

In order to develop a personalized investment plan suited to you and your financial future, we need to better understand how much risk you are willing to take. The old way — stereotyping investors based on their age — just doesn’t work. Neither does stereotyping investors with subjective semantics. The words “moderately conservative investing” may mean something different to you than it does to me.

That is why we utilize something called the “Risk Number” – a quantitative way to pinpoint how much risk you want, how much risk you actually have in your portfolio, and how much risk you need to take to reach your goals.

Your Risk Number not only helps our advisors develop your unique investment plan, it also helps set expectations for what can be anticipated for your portfolio. Keeping track of your investments this way helps you to understand that any six month result that falls within the range is right on track. This enables you to hang in there with confidence, even if markets are volatile.

Your Risk Number not only helps our advisors develop your unique investment plan, it also helps set expectations for what can be anticipated for your portfolio. Keeping track of your investments this way helps you to understand that any six month result that falls within the range is right on track. This enables you to hang in there with confidence, even if markets are volatile.

The first step is to answer a 5-minute questionnaire that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains.

Then we offer a complimentary consultation for you to learn more about our team and how we can use your Risk Number to build a unique plan you are comfortable with using our Connect Wealth Process . If you are interested in a review of your current portfolio and investment strategy, we also provide professional, written second opinions for a nominal fee. Contact us today.