It’s hard to believe that tax season is here already. In an effort to help our clients be...

In December of 2017, Congress passed the most extensive changes to the tax code since President Reagan’s Tax Reform Act of 1986: The Tax Cuts and Jobs Act (TCJA).

Signed into law by President Trump on December 22, 2017, these changes were originally intended to simplify the tax code, although the final package was mixed. While the tax rate for individuals and corporations was reduced, modifications were made to many tax rules including deductions. Even so, it is estimated that federal taxes for individuals will decline by an average of 8%.

Those impacted by the comprehensive changes include individuals, estates, trusts, corporations, and small businesses. This material reviews the changes likely to affect individuals as well as estates and trusts. For information regarding the effects of the TCJA on small businesses and corporations, please contact our offices at (817) 717-3812.

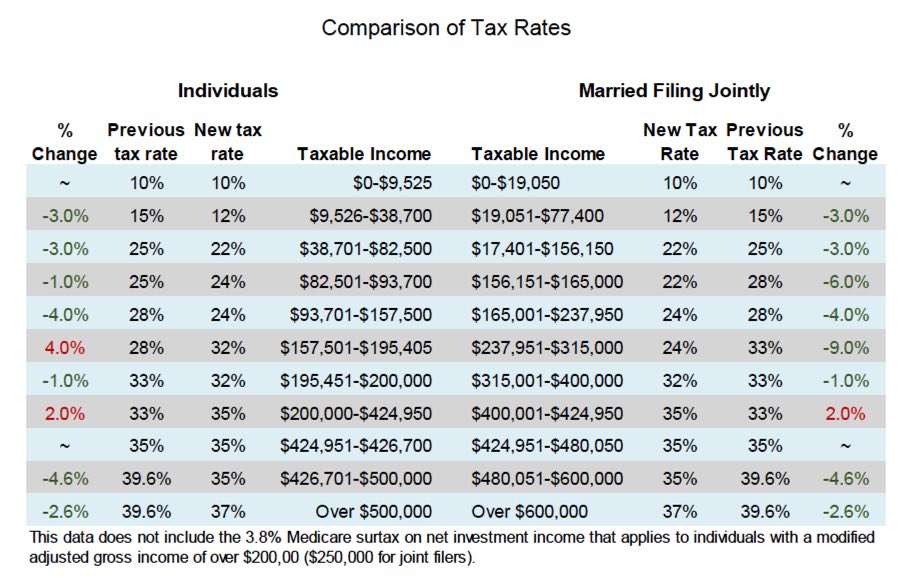

Under the new law, the current structure of seven tax brackets remains but the marginal rates have been lowered in most.

The new tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The average tax rate will fall to 19% from 20.7%, according to the Joint Committee on Taxation.

The 3.8% Medicare surtax on net investment income still applies for individuals, married couples, and trusts at higher income levels.

Significant Changes to Deductions and Exemptions

Deductions is one area most extensively affected by the tax code changes. Many popular deductions were either eliminated or scaled back in order to provide revenue and compensate for the decrease in marginal tax rates and the increase in standard deduction.

The existing standard deduction is nearly doubled for both single and joint filers. While in recent years roughly a third of taxpayers itemized deductions, tax experts predict that less than 10% will itemize going forward.

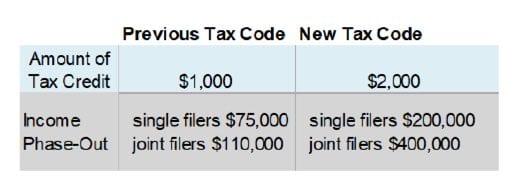

The new changes to the tax code doubled the Child Tax Credit and increased the phase-out income threshold, allowing more taxpayers to take advantage than before. This will help offset the loss of personal exemptions for families with children.

The Child Tax Credit applies to “qualifying children” (generally children under the age of 17 at the end of the tax year).

A $500 tax credit applies to dependents not considered “qualifying children” (dependent children over the age of 17 for example).

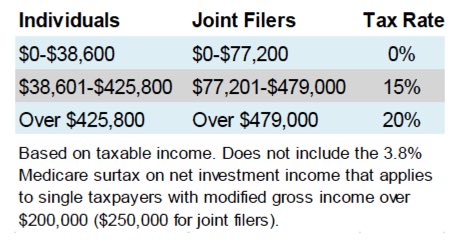

The tax rates for capital gains and qualified dividends were not changed by the new tax code. Previously, tax rates on long-term capital gains and qualified dividends aligned with the tax brackets. The tax brackets and corresponding tax rates were modified in the new tax code, so the income tax rates no longer align with the capital gain/qualified dividend

rates.

Going forward, the capital gain/ qualified dividend tax rates are based on certain income

levels, as shown below:

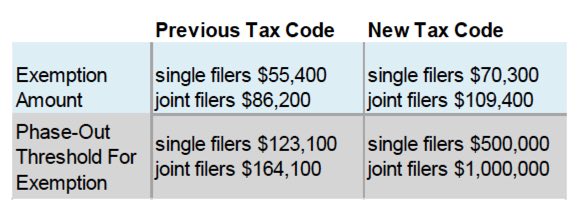

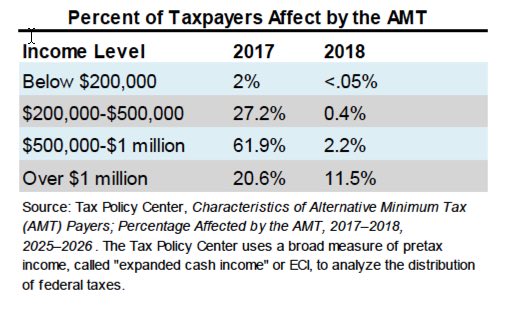

Because the exemptions were not initially indexed for inflation, over time the AMT started to apply to more taxpayers than intended, particularly more middle-income households. In an effort to ensure the AMT affected the intended taxpayer (high-income households), the new tax code increased the exemption amounts as well as the phase-out thresholds

for the AMT exemption.

As a result of these modifications, the number of taxpayers subjected to the AMT tax will

be significantly reduced.

Timing strategies for deductions. Due to the significant increase in the standard deduction, some taxpayers may benefit from alternating between claiming the standard deduction and itemizing deductions. Taxpayers can choose to “lump” as many deductions into years when itemizing – like larger charitable contributions and medical expenses, for example.

Charitable IRA rollover provision. Retired taxpayers (age 70½ or older) who will now claim the expanded standard deduction, can still receive a tax benefit from charitable contributions by having the donations sent to qualified charities directly from their IRA. Account owners are limited to $100,000 annually, which can include the required minimum distribution.

Careful evaluation of Roth IRA conversions. Since the option to recharacterize, or “un-do”, a Roth IRA conversion is no longer available, IRA owners need to carefully evaluate the advantages and disadvantages of Roth IRA conversions.

More flexibility for education savings. The new tax code brought changes to the kiddie tax and the expanded use of 529 college savings plan, allowing more flexibility when saving for education expenses.

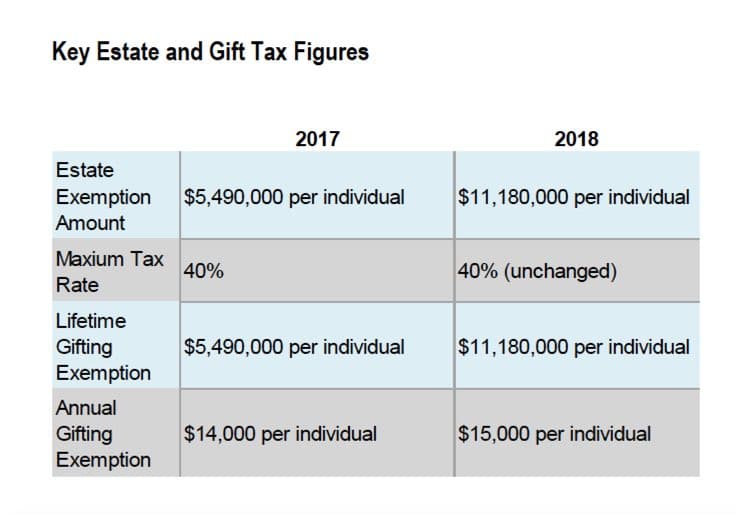

The new tax code, which nearly doubled the unified, lifetime exemption for estates and gifts, will significantly reduce the number of taxable estates. In 2018, an estimated 1,900 estates will be taxable under the new tax law, but 6,500 estates would have been taxable under the pre-2017 tax law, according to the Tax Policy Center.

It is important to remember that taxes are just one facet of estate planning. Proper estate planning includes strategies to address wills, power of attorney, health-care directives, coordinated beneficiaries on IRA accounts and insurance, and other areas such as asset protection.

As a result of the recent tax law changes, investors should consider the importance of seeking professional advice in reviewing existing estate plans, trusts, and gifting.

To understand how these tax code changes and planning considerations may affect your unique financial plan, it is important to consult your financial advisor and a qualified tax or legal professional.

This material is for general information only and not intended to provide specific advice or recommendations for any individual. Virtus Wealth Management, Level Four Advisory Services and LPL Financial do not provide tax advice.