In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

When you retire, it’s nice not to worry about having enough money coming in every month to pay the bills and guaranteed income can help. A pension is a form of guaranteed income, but those are few and far between. You can also build your own income stream with an annuity, and we can help determine if that makes sense for you. That said, Social Security is another form of guaranteed income, and almost everyone has access to it.

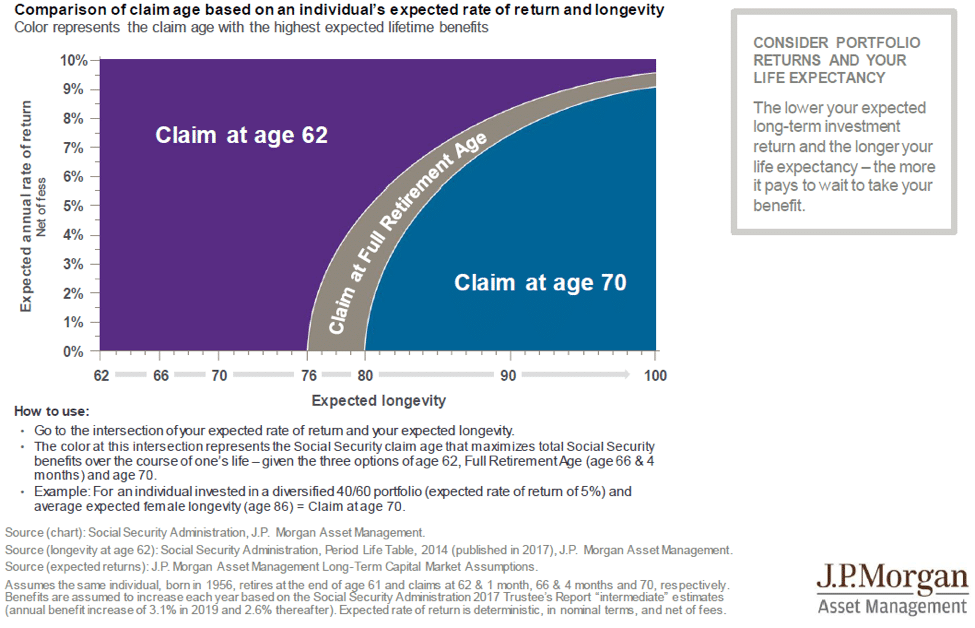

The chart below illustrates that, if you are a conservative investor with a longer life expectancy, you may want to consider claiming your social security benefit at 70. On the other hand, if you are a more aggressive investor and have a limited life expectancy, you may want to claim your benefit earlier. Or, you may fall somewhere in between.

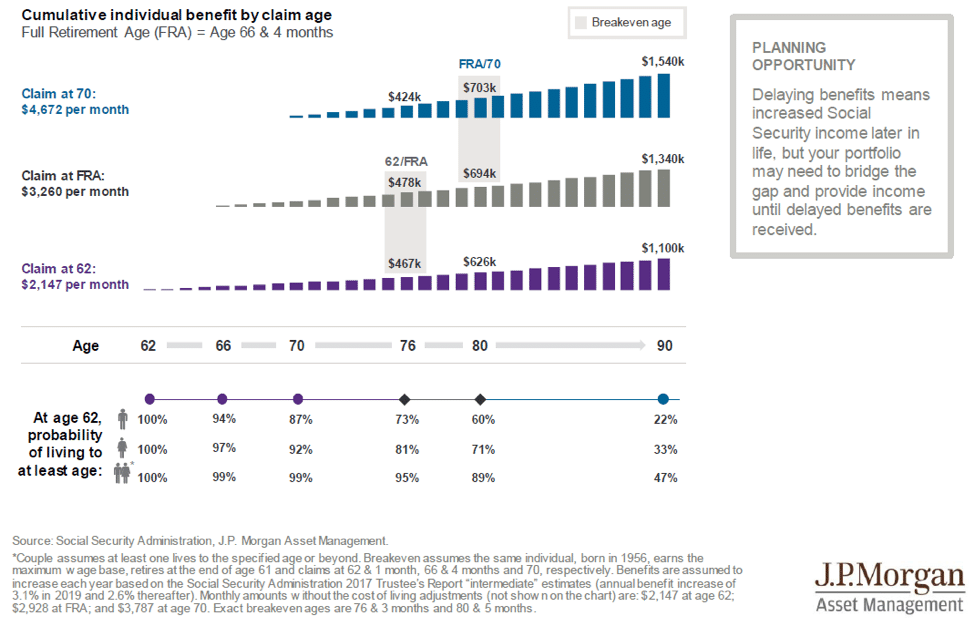

You can also consider the breakeven points and life expectancy probabilities illustrated below. The first chart shows that the breakeven point for claiming social security at 62 is 76, and the breakeven point for claiming at 70 is 80. The second chart shows the probability of living to a certain age if you are currently 62 years old. It is critical not to under-estimate your life expectancy when attempting to maximize your social security benefits. It is highly likely that you will live longer than you think!

Using guaranteed income to pay for your lifestyle can make retirement more enjoyable and less stressful, and as you can see, there are several variables specific to your situation to determine how to maximize your social security benefit. We are here to help!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes.

Annuities are long-term investment vehicles designed for retirement purposes. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply.