In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

Going into 2018 and in the midst of an 8 year bull market, content can set in. While being content in life is great, being content in the stock market can be very dangerous.

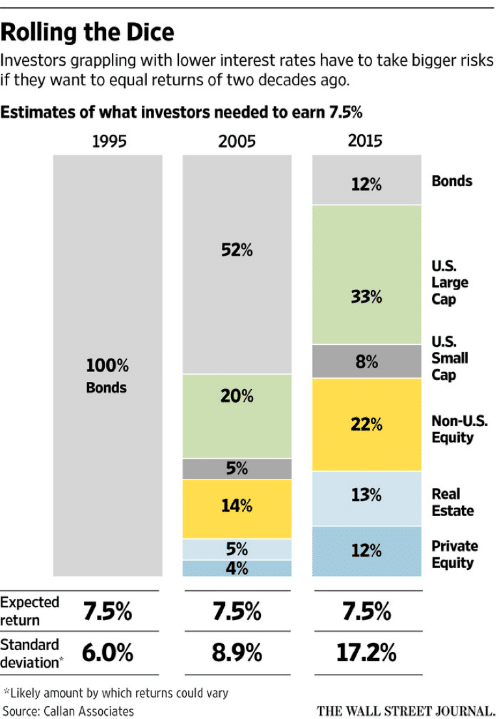

I have written a couple of times regarding my concern with the amount of risk investors are taking, in many cases unknowingly. Volatility will return one day. Are you aware of your downside? Following is a chart that appeared in the Wall Street Journal comparing the amount of stocks needed in a portfolio to reach a 7.5% return in the years 1995, 2005, and 2015:

In an attempt to not get too technical and boring here, it must be pointed out that the standard deviation in each year is very important. Due to needing higher risk investments, the standard deviation in 2015 is much higher than the other two periods. However, what does a 17% standard deviation mean? At a high level, it means the return will be within the range of a negative 9.7% (7.5% minus 17.2%) and a positive 24.7% (7.5% plus 17.2%) two-thirds of the time, or periods. The important thing to consider is the other one-third of the time. This is calculated by taking 2 times the standard deviation of 17.2 and adjusting either way. Thus, you should be ok with a downside risk of approximately 27%, which is the expected return of 7.5% less 2 times the standard deviation of 17.2. This means you should be ok with losing 1/3rd of your portfolio value in a year.

If you are young and not needing to touch the money for many years, this probably isn’t as worrisome as it would be to those who are retired and need income off the portfolio to pay the bills.

I usually don’t like to get too technical in my articles but in this case it is needed to fully explain the variations in returns when stocks are such a big portion of a portfolio. The main takeaway here is not to scare anyone off of stocks. We still think the economic conditions are such that stocks should prosper again in 2018. However, there is always the unknown and markets can be unpredictable. After reading this article I hope you consider your risk and ensure that you are okay with the downside. Volatility will return at some point, and we don’t want to be surprised.

Investing involves risk including loss of principal.

No strategy assures success or protects against loss.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Standard deviation is a historical measure of the variability of returns relative to the average annual return. If a portfolio has a high standard deviation, its returns have been volatile. A low standard deviation indicates returns have been less volatile.