It’s hard to believe that tax season is here already. In an effort to help our clients be...

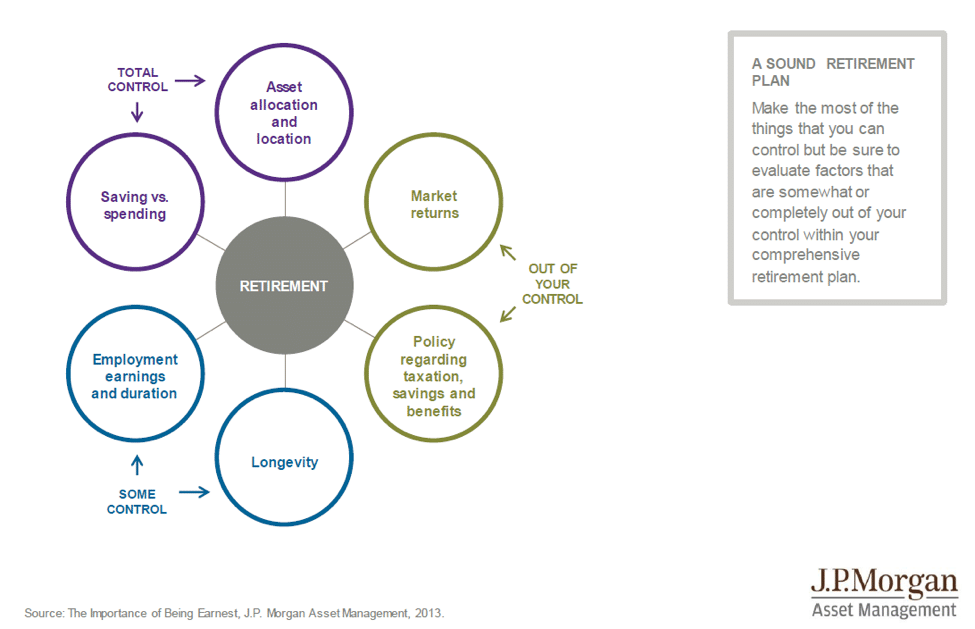

As with all things in life, some things are in our control in retirement planning and some things are not. This is also related to the first habit noted in The 7 Habits of Highly Effective People by Stephen Covey – Be Proactive. Focus on the things that are in your “Circle of Influence”, and constantly work to expand it to your “Circle of Concern”. For retirement planning, your “Circle of Influence” includes saving, spending, and asset allocation, and your “Circle of Concern” includes employment earnings, employment duration, and longevity (your health).

You have total control over your Saving, Spending, and Asset Allocation. You have some control over your Employment Earnings, Employment Duration, and your Longevity (health). Don’t sit still in a reactive mode, waiting for problems to happen before taking action. Be proactive …

Here comes another competitive swimming analogy! Oh boy … I bet you can’t wait! The best way to sum this up is, “Swim your own race.” You can’t control what the other swimmers do, the temperature of the water, or the weather. You can control your training, the rest you get before the race, your eating habits, and your mental preparation. Being and staying proactive is the name of the game. Work with your advisor/coach to “Control the Controllable” to win your retirement race!