It’s hard to believe that tax season is here already. In an effort to help our clients be...

It’s me again. Your friendly financial advisor and parent of 2 kids in college. I feel your pain and/or your stress of preparing for the inevitable. This is Part 2 of our 2 Part Series on College Planning. The first part illustrated the importance of college, projected cost, and the reality (or lack thereof) of financial aid. This part will explain the “Expected Family Contribution” at a high level and illustrate how planning ahead (even if starting late) can help you get through it. There is power in college planning; it makes a difference.

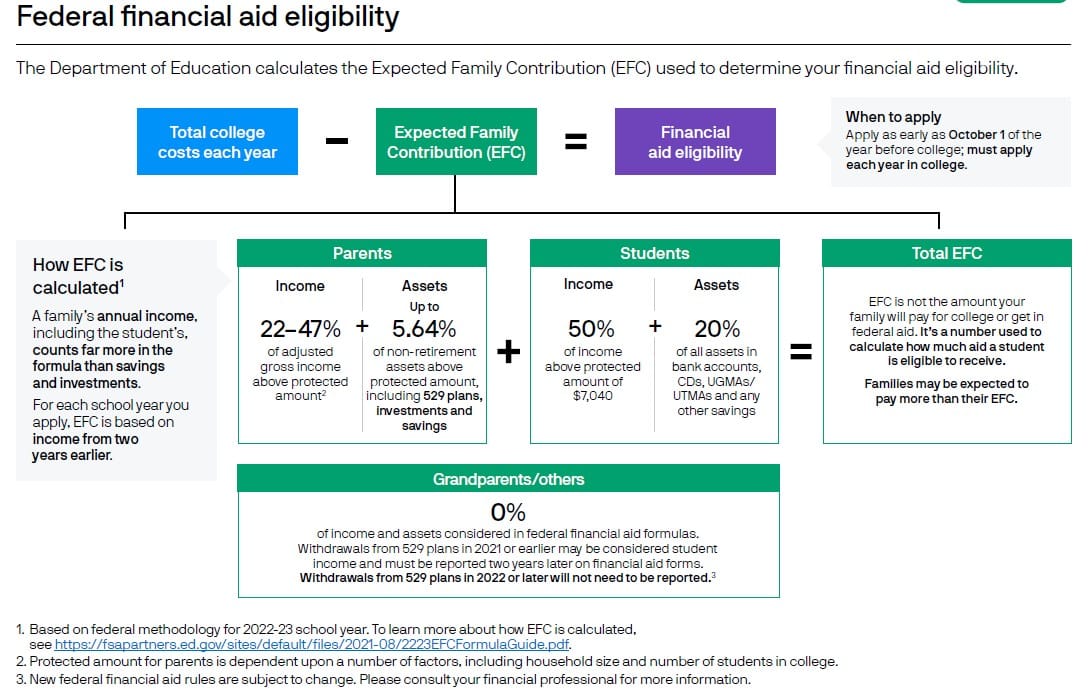

First, let’s review the “Expected Family Contribution” (EFC). I’m not going to get into the details too much here, but the EFC is basically the minimal amount the government expects you to be able to pay each year for college. It determines the amount that you may or may not be eligible to receive in financial aid, and it is largely based on your annual income. Here’s a chart. Feel free to dig into the details. It’s complicated.

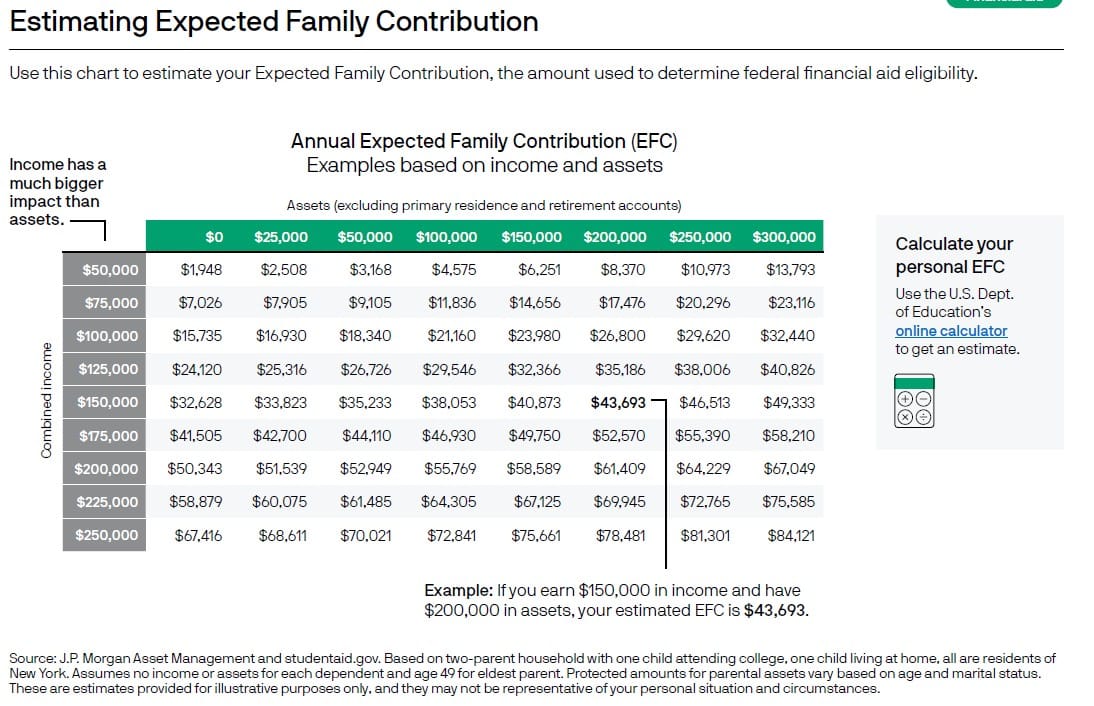

I like the chart below better because it attempts to help you estimate your EFC. Let me guess … your EFC is larger than you thought, right!?!? Remember, this is an annual number that you are expected to be able to contribute to your child’s education year, after year, after year.

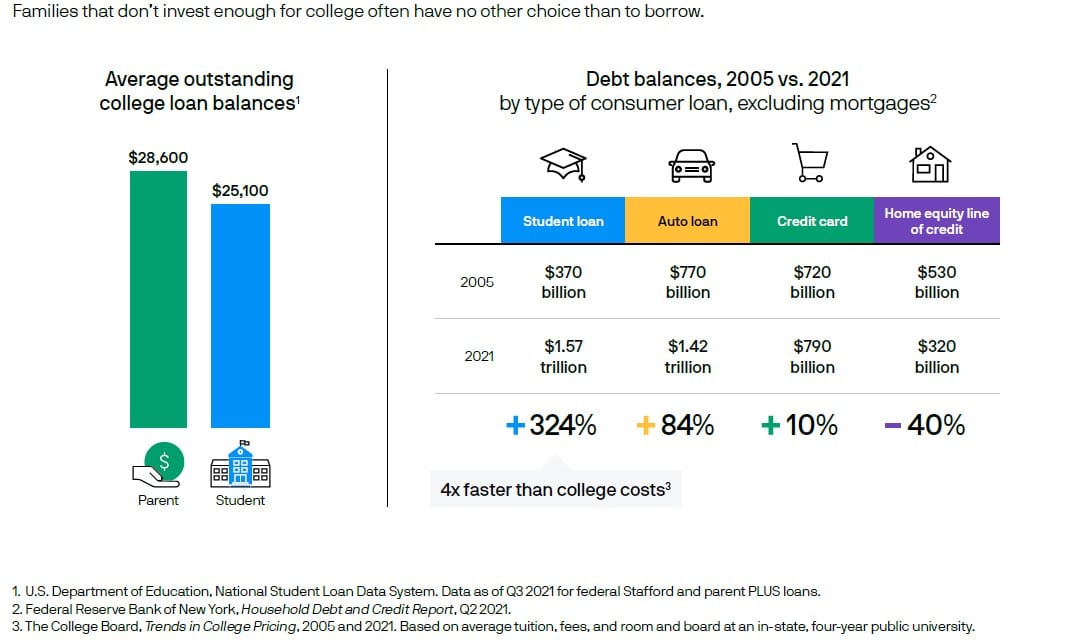

With that in mind, it’s no wonder that college debit is rising.

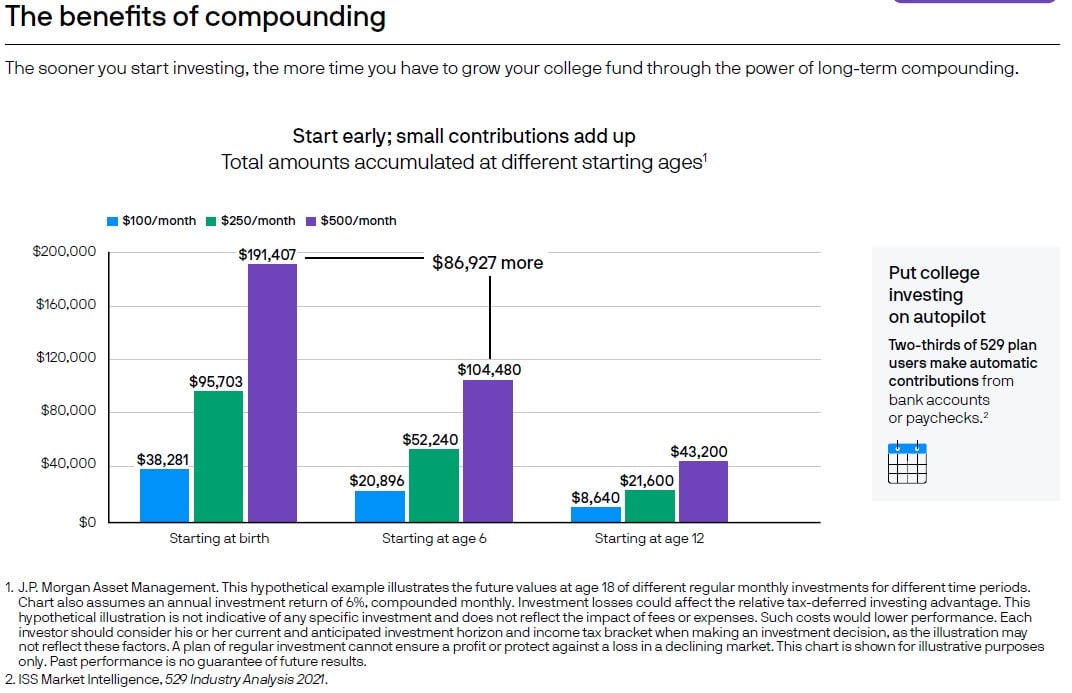

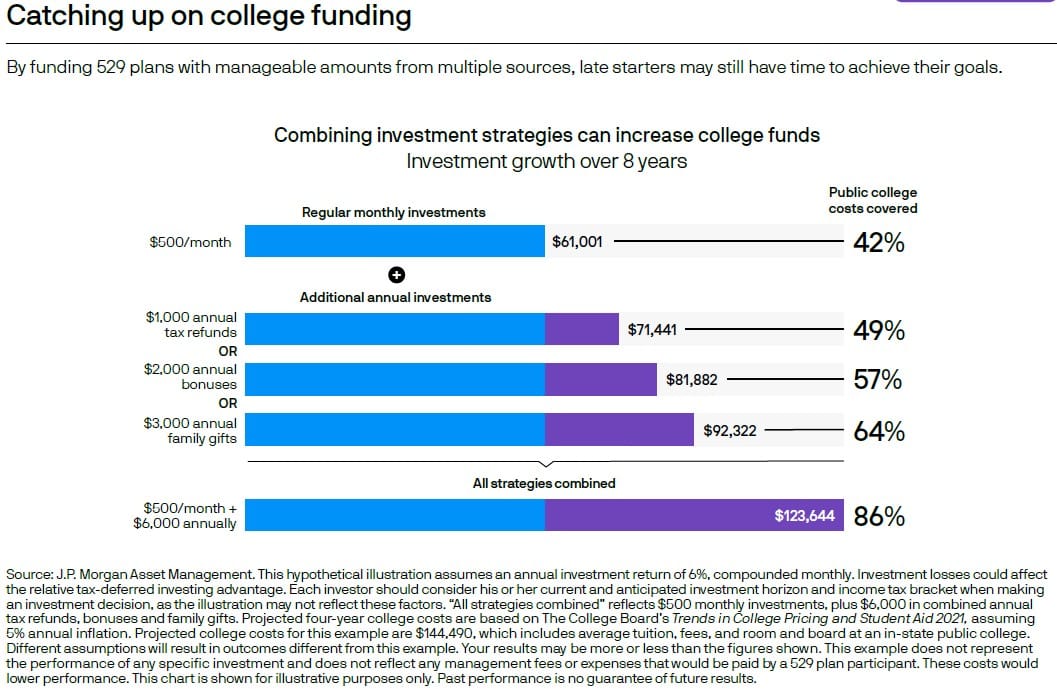

So, what are we going to do about it? We are going to develop a college plan.

1 Sallie Mae, Higher Ambitions: How America Plans for Post-secondary Education, 2020.

Wow! Just like Part 1, Part 2 also has a lot of charts. A picture is worth 1,000 words. Seeing is believing. It’s not too late to develop a plan to save college. It’s also not an “all or nothing” deal. Saving to fund part of college along the way is better than taking loans for all of it. Maybe you have enough income to pay as you go and supplement with savings? Maybe you save enough to only take government loans which are at more favorable rates than private loans? Maybe you use a combination of strategies? Planning is the key. We are here to help you understand your options, face the issues, and empower you to get there.