In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

We are always looking for ways to save pretax dollars that can be put to good use. A medical savings account such as a Health Savings Account (HSA) or Flexible Spending Account (FSA) is a great way to save pretax dollars that, if used for qualified medical expenses, will be completely income tax free. However, there are unique rules for each one of these accounts that are important to understand so you know how they can best be utilized in your financial plan.

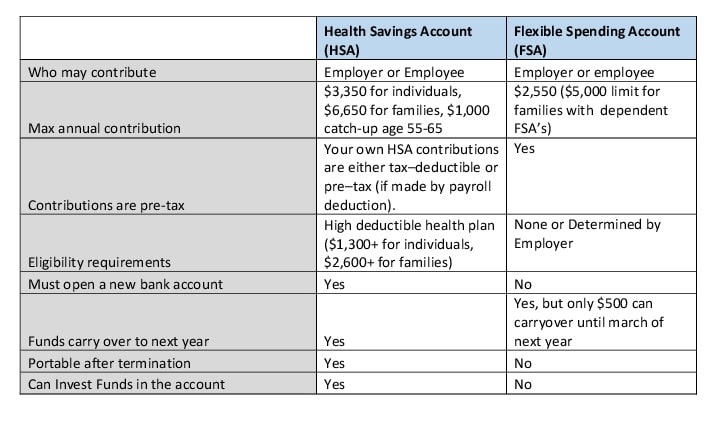

Let’s take a closer look at the specifics of both an HSA and FSA:

A Health Savings Account (HSA) allows you to contribute pretax dollars that can then be used for qualified medical expenses but only if you have a high deductible health plan. In order to qualify for this account individuals must have a deductible of at least $1,300 and out-of-pocket expenses limit must not exceed $6,450. For families the deductible must be at least $2,600 with out-of-pocket expenses not to exceed $12,000. Also, in order to qualify you must be younger than age 65. If you qualify for this account it can play several different roles in one’s financial plan.

In 2015 an individual can contribute up to $3,350 pre income tax dollars, $6,650 for families, and an additional $1,000 catch-up provision for those over 55 years old. Unlike other medical savings accounts (such as an FSA) your employer does not have to sponsor a Health Savings Account, anyone who qualifies can get one. Since they are not employer sponsored they are completely portable, meaning you bring it with you when you leave jobs and keep it as long as you would like. The funds in an HSA can be invested and earn interest. So, quick recap, a family with a high deductible health insurance plan can put $6,650 a year into an HSA, grow that money tax deferred, and then use it for qualified medical expenses at any point in their life without paying income tax on it. Think of it as a medical IRA. Keep in mind that if you withdraw funds before age 65 that are not used for medical expenses you will pay a 20% penalty plus income taxes. If you are age 65 or older you can withdraw funds without penalty, you just have to pay income tax.

Also note that money in an HSA can be used for some medical expenses not covered by insurance, such as LASIK eye surgery. For more facts about HSA’s and information on how to get started, visit the Resource Links under the Investment Tools section of our website https://www.virtuswealth.com/.

A Flexible Spending Account (FSA) has many more limitations than an HSA but can provide some value in saving on taxes nonetheless.

FSA’s are employer sponsored medical savings accounts that allows workers to contribute pretax dollars that can be used on qualified medical expenses without paying income tax. The maximum 2015 contribution for a family or individual is $2,550. However, there are dependent FSA’s that cover things like child care, in which you can contribute up to $5,000 for a family.

FSA’s are set up and run by your employer, therefore they are not portable, and once your employment ends your FSA ends. Also, you must use the money you contribute by years end or it goes back to your employer. However, a recent provision has been added to allow you to carry over $500 until March of the next year to provide continuity in the account. Due to the time limitation it is very important to have some sort of estimate of your yearly medical expenses to ensure you can use all the money you deposit.

Here is a chart to summarize each accounts features:

Information for this chart was obtained through the HSA Resources web page (https://www.hsaresources.com) and the IRS web page (http://www.irs.gov).

A HSA cannot be used in conjunction with a full FSA account, however, there are limited FSA’s that just allow for dental and vision expenses which can be used in conjunction with an HSA.

Using one of these accounts may not make or break a financial plan but every bit that we can save on taxes and grow money tax deferred should be examined. For more information or to determine whether a HSA or FSA is right for your financial situation please contact your Human Resources and Financial Professionals.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual, nor intended to be a substitute for specific individualized advice.