In my last article, I discussed the importance of proper titles in regards to qualified accounts,...

The cultural phenomenon that is HBO’s Game of Thrones, a show of political scheming, heroic battles, and of course, dragons and zombies, is fast approaching its conclusion. Anyone who has watched the show over the last 8 seasons loves to debate which characters will be alive at the end or who will sit on the Iron Throne but, taken from a financial planning point of view, there are more practical topics and discussions that can be made from the experiences of our favorite Game of Thrones characters. Here are 7 financial lessons that can be drawn from some of our favorite, and least favorite (looking at you, Joffrey), characters.

Always Pay Your Debts

This common saying of House Lannister, the richest family in Westeros, does not just have to be used in reference to plotting horrible, horrible things for your enemies. You can also keep this in mind when making financial decisions. There are two steps to this: 1) Don’t bite off more than you can chew. When taking big loans like a mortgage, auto loan, and student debt make sure you stay within your means and can comfortably make the required payments. 2) Pay off bad debt quickly. Some debt can be good, such as a low rate mortgage, but most other debt is bad. Identify high interest rate debt and develop a focused plan to eliminate that debt quickly. You may not be able to just blow it all up with Wildfire like Cersie, but a systematic plan of principal payments can get the job done all the same.

Do Not Wait to Plan Your Estate

As King Robert Baratheon showed us, waiting until the last minute to try to put estate documents in place can do more harm than good. By not having the proper documents in place early enough his will was contested, allowing Joffrey to take control of the Seven Kingdoms. A messy estate situation can cause a rift amongst family and friends and cause a lot of confusion during very stressful times. Having these 4 essential estate planning documents developed and reviewed on a regular basis is one of the most crucial and often overlooked aspects of financial planning. Having a will, naming beneficiaries, having medical and durable Powers of Attorney, and having Physicians Directives are all very simple to put in place and each plays a crucial role during and after your lifetime. Death is certain, but the timing is not, so do not wait to plan your estate.

As King Robert Baratheon showed us, waiting until the last minute to try to put estate documents in place can do more harm than good. By not having the proper documents in place early enough his will was contested, allowing Joffrey to take control of the Seven Kingdoms. A messy estate situation can cause a rift amongst family and friends and cause a lot of confusion during very stressful times. Having these 4 essential estate planning documents developed and reviewed on a regular basis is one of the most crucial and often overlooked aspects of financial planning. Having a will, naming beneficiaries, having medical and durable Powers of Attorney, and having Physicians Directives are all very simple to put in place and each plays a crucial role during and after your lifetime. Death is certain, but the timing is not, so do not wait to plan your estate.

Identity Theft is Killer

The Faceless Men are some of the deadliest assassins in the entire Game of Thrones universe. They can change their face, blend in with the crowds, and attack in sneaky ways when you least expect it. The same can be true for identity theft and financial cyber criminals. Whether it be racking up credit card debt in your name or hacking accounts and stealing money directly, identity theft can take many forms. There are precautions you can take such as freezing your credit, keeping large cash balances in secured accounts, and be very mindful of online activity that can greatly reduce your chances of falling risk to this threat.

The Faceless Men are some of the deadliest assassins in the entire Game of Thrones universe. They can change their face, blend in with the crowds, and attack in sneaky ways when you least expect it. The same can be true for identity theft and financial cyber criminals. Whether it be racking up credit card debt in your name or hacking accounts and stealing money directly, identity theft can take many forms. There are precautions you can take such as freezing your credit, keeping large cash balances in secured accounts, and be very mindful of online activity that can greatly reduce your chances of falling risk to this threat.

Winter is Coming

The House Words of the Starks, “Winter is Coming” are not just applicable to protecting oneself from the Night King and the Army of the Dead, but they apply to personal finance as well. There are inevitably times when you are going to have to rely on your savings to get you through tough times. Whether it be medical bills, home improvements, or losing your job, there are a myriad of things that can and most likely will happen to you over your lifetime where you will need to have immediate cash on hand. For this reason, we recommend our clients try to keep at least 3-6 months of living expenses available as an emergency savings that they can access quickly in case of emergency or unexpected expense. When the long night comes, will you be ready?

The House Words of the Starks, “Winter is Coming” are not just applicable to protecting oneself from the Night King and the Army of the Dead, but they apply to personal finance as well. There are inevitably times when you are going to have to rely on your savings to get you through tough times. Whether it be medical bills, home improvements, or losing your job, there are a myriad of things that can and most likely will happen to you over your lifetime where you will need to have immediate cash on hand. For this reason, we recommend our clients try to keep at least 3-6 months of living expenses available as an emergency savings that they can access quickly in case of emergency or unexpected expense. When the long night comes, will you be ready?

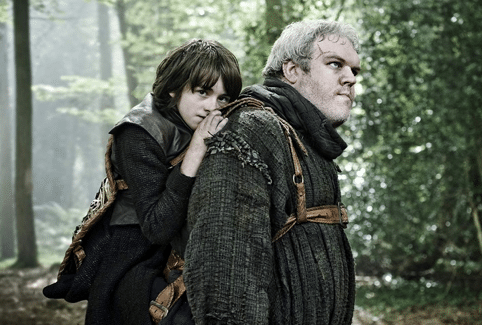

Have a Financial Hodor

Disability insurance is like having a financial Hodor. According to the Social Security Administration more than one in four of today’s 20-year-olds can expect to be out of work for at least a year because of a disabling condition before they reach the normal retirement age1. If you are ever disabled for an extended period of time and unable to work, disability insurance can kick in and allow you a chance to stick to your financial plan and accomplish your goals. The insurance companies may not sacrifice themselves to save you and the fate of humanity like the lovable giant Hodor, but they can come in clutch during tough times if you plan accordingly.

Disability insurance is like having a financial Hodor. According to the Social Security Administration more than one in four of today’s 20-year-olds can expect to be out of work for at least a year because of a disabling condition before they reach the normal retirement age1. If you are ever disabled for an extended period of time and unable to work, disability insurance can kick in and allow you a chance to stick to your financial plan and accomplish your goals. The insurance companies may not sacrifice themselves to save you and the fate of humanity like the lovable giant Hodor, but they can come in clutch during tough times if you plan accordingly.

Weddings Can Be Murder

Weddings are a magical time of love, new beginnings, and family coming together. Unfortunately, they can also be murder for your finances if not budgeted for. Whether it be the cost of an engagement ring, wedding venue, feeding the masses, or the honeymoon, the cost of a wedding can be outrageous. According to an article on thestreet.com2, the average cost of a wedding in 2017 was over $33,000! There are plenty of costs to go around so planning and budgeting for the big day applies to couples, parents, grandparents, and anyone who wants to avoid having their financial plan derailed.

Weddings are a magical time of love, new beginnings, and family coming together. Unfortunately, they can also be murder for your finances if not budgeted for. Whether it be the cost of an engagement ring, wedding venue, feeding the masses, or the honeymoon, the cost of a wedding can be outrageous. According to an article on thestreet.com2, the average cost of a wedding in 2017 was over $33,000! There are plenty of costs to go around so planning and budgeting for the big day applies to couples, parents, grandparents, and anyone who wants to avoid having their financial plan derailed.

Prophesies Are Often Misinterpreted

Many in the media claim to be stock market prophets, shouting from the rooftops that they know exactly what will happen in the near future. They speak with conviction and can incite fear and cause investors to make rash decisions that do not comply with their long-term investment strategy. Trying to time the market is a very dangerous game that can leave you over exposed to potential risk and do irreparable damage to your portfolio. Stannis Baratheon and Melisandre are a great example of this. Instead of trusting his long-term strategy he trusted the Red Woman and marched into a battle everyone knew he could not win. Have a long-term strategy and stick to it. There are no short cuts in successful long-term investing, it takes consistency and dedication.

Many in the media claim to be stock market prophets, shouting from the rooftops that they know exactly what will happen in the near future. They speak with conviction and can incite fear and cause investors to make rash decisions that do not comply with their long-term investment strategy. Trying to time the market is a very dangerous game that can leave you over exposed to potential risk and do irreparable damage to your portfolio. Stannis Baratheon and Melisandre are a great example of this. Instead of trusting his long-term strategy he trusted the Red Woman and marched into a battle everyone knew he could not win. Have a long-term strategy and stick to it. There are no short cuts in successful long-term investing, it takes consistency and dedication.

Here at Virtus, we believe that successful wealth management extends beyond financial planning and investing. Wealth management is, by definition, a holistic approach to understanding and providing solutions to all of the aspects of a client’s finances. We believe that by building a solid and valuable partnership with our clients, we can coordinate and unify the decisions in their financial life, so that those decisions complement each other and produce enhanced results. If you would like more information, please feel free to give our offices a call at (817)717-3812.

The information provided is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All investing involves risk including loss of principal. No strategy assures success or protects against loss.